The Evolution of Blockchain Interoperability

A deep dive into the progression of how different blockchains communicate with one another

Contents:

Background

Multi-chain Interoperability

Cross-chain Interoperability

Touching on Omnichain

Conclusion

Before we jump into the evolution of blockchain interoperability, it is important to understand how and why we got there.

It may be hard to imagine, but prior to the ~197 blockchains which exist today, there were only a few chains around, and Bitcoin and Ethereum dominated the majority of onchain activity. While Bitcoin remained “pure” in its function as a peer-to-peer financial network, Ethereum was developed with a vision to expand the possibilities of what can be done with blockchain technology. And so, with the introduction of a simple, turing-complete programming language (Solidity), and the implementation of onchain smart contracts, Ethereum built an ecosystem of decentralized applications which has evolved (through a rigorous process) into what we know as Web3 today.

Storing transactions and other data “on chain” requires block space, which is limited by design. As demand for using Ethereum grew, this meant that demand for block space grew as well. In its design, Ethereum had implemented transaction fees (aka gas fees) as a way to monetize the computational effort required in processing and executing transactions - which take up blockspace. As per the laws of supply & demand, more demand for blockspace = higher transaction fees.

This led to the development of new chains seeking to optimize on Ethereum’s shortcomings, particularly expensive transaction fees and limited throughput/performance.

And thus, the multi-chain ecosystem was born.

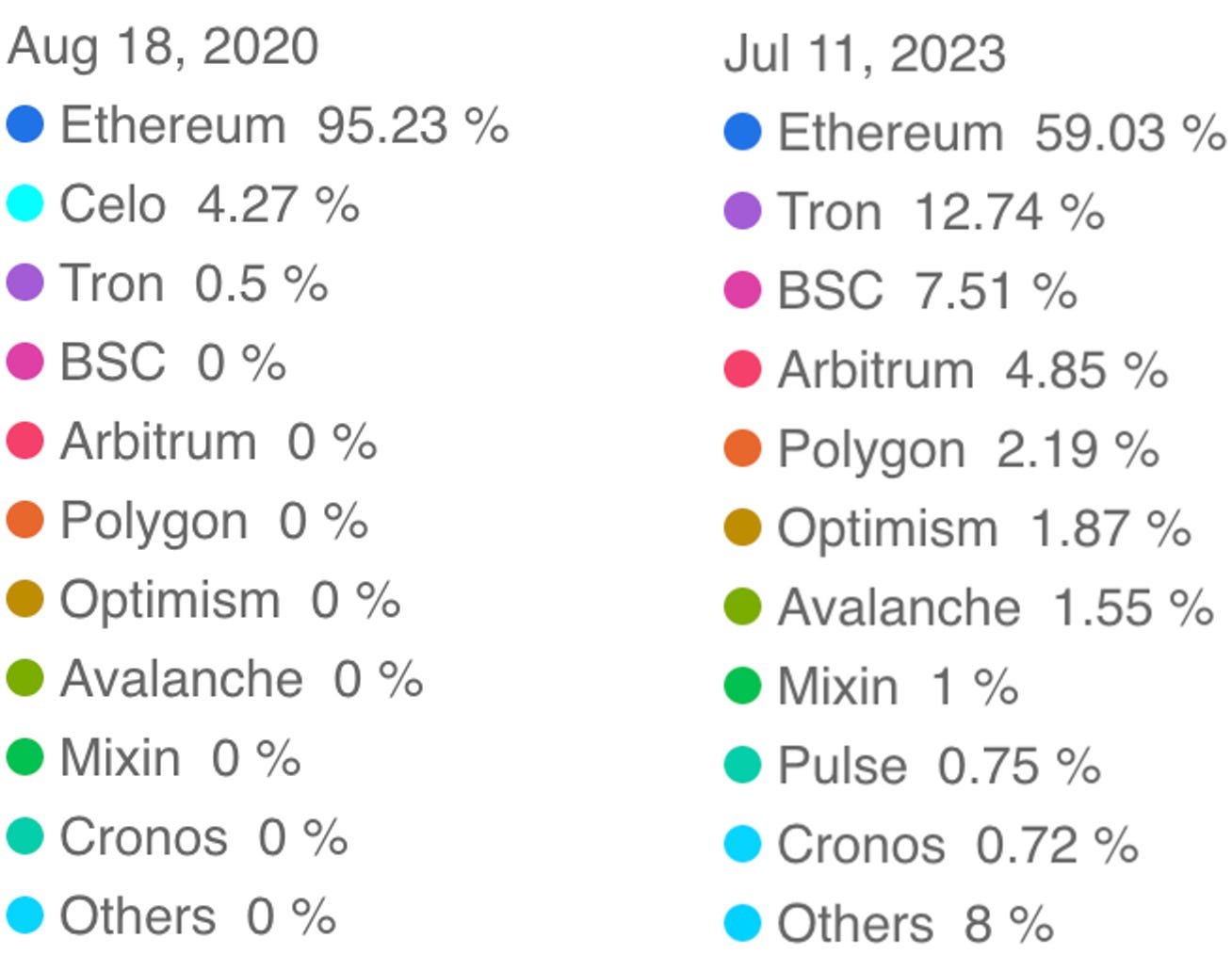

The difference in DeFi market share between chains, just under 3 years apart. As you can see, Ethereum still dominates >50% of onchain activity, but users have a handful of different chains and ecosystems to choose from.

Interoperability

Interoperability, by definition, is the “ability for a system to work with or use the parts or equipment of another system”. Consider the context of the Internet among computers; machines which are limited in their own capacity. Now consider a network, which moves data from one machine to another, immediately creating a new dimension of utility for the individual machines, which are now part of a greater whole.

This concept can be directly applied to blockchains, where interoperability refers to the ability to communicate with other chains. More specifically, it is the ability to transfer data from one smart contract on the source chain, to another smart contract on the destination chain.

Whether it is better performance, cheaper fees, or better yields; users will continue to travel across different chains in order to meet their specific needs. No matter which way you put it, blockchain interoperability is important. Blockchains need to able to communicate and interact with one another as seamlessly as possible in order to reach their full potential.

In this paper we examine the evolution of blockchain interoperability.

Multi-Chain Interoperability

Multi-chain refers to a world of independent blockchain networks, which connect different blockchains by providing a shared set of fundamental design and security properties.

Think about a nation and its cities - although each city may be unique in its own way, they all fall under the same Federal jurisdiction. Residents of different cities share the same benefits from the federal level; judicial system, military defense, communication channels, monetary policy, etc.

In a multi-chain ecosystem, blockchains are like cities within the same nation, or network. A network provides chains with standards for consensus, and allows these supported chains to communicate with one another natively.

For reference, a consensus mechanisms refers to a set of rules used to validate, execute, and store transactions on a blockchain. In order for a transaction to be stored, all nodes securing the network must agree on the legitimacy of the transaction.

Multi-chain ecosystems can be classified into 3 distinct models: “Hub and Spoke” models, Layer 1, and Layer 2 protocols.

Hub and Spoke models

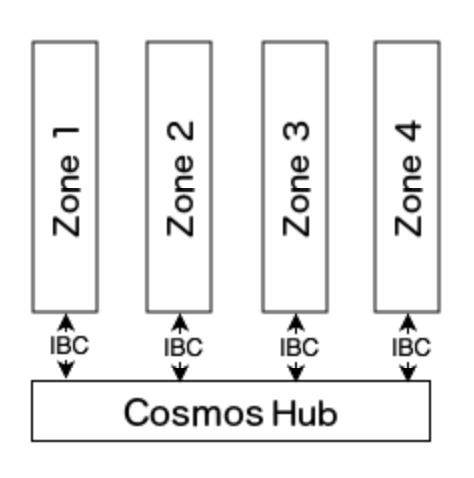

The Hub-and-spoke model is a network architecture where a central hub connects a number of smaller entities called spokes. Cosmos first brought this concept onchain by introducing Zones - independent blockchains which share a consensus engine (Tendermint Core) and are connected by a communication protocol (IBC).

Another similar example is Polkadot ; a blockchain network which uses a relay chain (the central hub) to provide a shared consensus engine for independent Parachains , and follows a communication standard (XCM) for interoperability.

These models offer a lot of modularization for chains, though they are also known for their strict criteria and thorough process for onboarding to their ecosystems. While this process is inherent to the ecosystems’ security standards, it makes attracting new projects, and thus new users and growth, a challenge.

Layer 1: EVM

The Ethereum Virtual Machine (EVM) enables chains to achieve interoperability with Ethereum, which still dominates DeFi market share to this day. Although these chains have their own consensus and security mechanisms, they can transfer assets between one another and operate under the EVM multi-chain ecosystem.

Notable examples include the Binance Smart Chain, Avalanche, and Fantom.

Layer 1: Beyond EVM

Blockchains like Solana and Terra were built to push the multi-chain ecosystem beyond the EVM. This meant using different consensus mechanisms (Proof of History on Solana, delegated proof-of-stake on Terra), different programming languages, and using native assets for paying gas fees and securing the network.

Solana is one of the few “true” alt-L1s, and in my opinion, the frontrunner for the title. While activity has decreased in the bear market and the wake of the FTX implosion , there have been important developments in the ecosystem , and the strength of the Solana community is undeniable. People argue that Solana’s high throughput and cheap fees comes at the cost of decentralization; I won’t go there in this paper, but the fact remains that transacting on Solana is an absolute breeze compared to a majority of chains out there.

Activity on Terra peaked in early May 2022, pushing Ethereum’s DeFi market share below 50% for the first (and only) time so far. It is far more important to consider, however, that Terra was home to arguably the biggest single collapse in DeFi with the downfall of UST and LUNA.

Layer 2

Layer 2s are blockchains built on top of Layer 1s. They are scaling solutions which maintain the security guarantees of the underlying network while improving performance and usability for users, and “decongesting” traffic on the main network by offloading the computation process.

Layer 2 protocols come in different forms - whether it’s sidechains like Polygon, rollups like Arbitrum and Optimism, or state channels like the Bitcoin Lightning Network and Connext.

Layer 2s, designed for making their underlying L1s cheaper and faster, remain a controversial topic. While they have seen impressive growth in the last year , they are often criticized for being too centralized in design, usually relying on a sequencer operated by a centralized entity to process transactions.

Analysis

Let’s take a step back and analyze the multi-chain ecosystem.

Overall, the rise of the multi-chain ecosystem reflected web3’s inherent need for higher throughput and cheaper transaction fees among crypto users. For teams, deploying their dApps on multiple chains become an almost necessary strategic decision, as it allowed them to tap into wider user bases and thus more sources of liquidity.

The multi-chain ecosystem allowed applications and their users, to choose the right chain on the right network for them, based on their preferences for consensus, security, and interoperability standards. The isolation of chains in multi-chain ecosystems created a security assurance; an exploit on network A will not affect chains on network B.

And yet, this state of interoperability was far from perfect. Like with many new technological advances, the multi-chain ecosystem created new problems in place of the ones it solved.

The underlying issue lies in the fact that these different networks - namely Cosmos, Polkadot, EVM, as well as monolith chains like Solana - could not communicate with one another natively. This meant that developers needed to create new codebases for each chain they wished to deploy on, creating new security vulnerabilities in the code, and additional overhead for teams, as they needed to migrate liquidity on the new chain to bootstrap adoption and growth.

For users, this often meant creating new wallets, which needed to be “loaded” with at least some currency for gas fees. Using many different chains naturally increases exposure to users’ risk overall, creating an overall less-than-ideal user experience.

Furthermore, the rise of the multi-chain world caused the fragmentation of liquidity - value of assets “onchain” was spread throughout many different chains, and each new environment required initial liquidity to bootstrap growth. Liquidity is the ease with which an asset can be bought and sold, and the less liquidity available the higher the “slippage”, or loss of value, traders would incur on trades.

This created a feedback loop - if a chain had high Total-Value-Locked (TVL), users would flock to trade there, and likewise if a chain was new and had lower TVL, users naturally avoid it. This led to the rise in liquidity mining - a model of creating initial growth and adoption by bribing users with token rewards. Spoiler alert - most of these chains failed to retain any of this liquidity.

So it doesn’t take much to realize that the more chains are deployed and used, the more spread out, or fragmented, the overall liquidity will be.

psst. I suggest reading my Bankless article on Chasing Sticky Liquidity if you are curious to learn more.

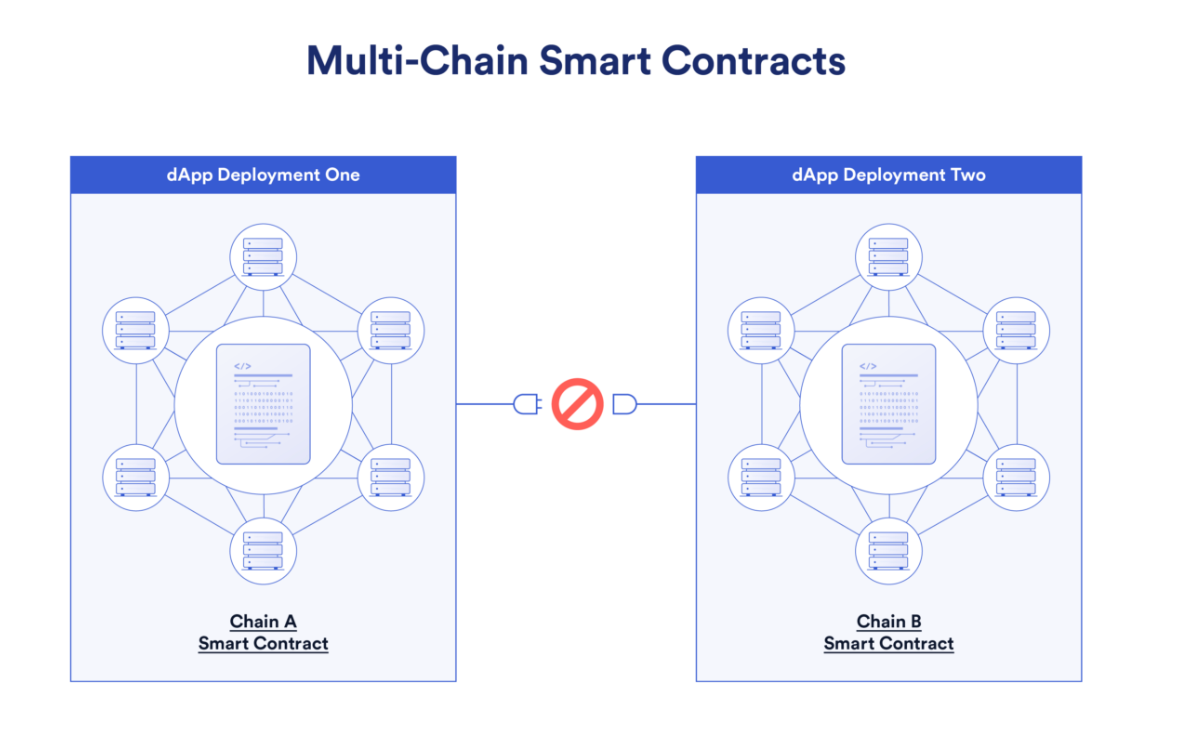

The fact is that heterogenous chains in a multi-chain world cannot natively communicate with other.

This is where cross-chain interoperability comes in.

Cross-chain Interoperability

Cross-chain communication protocols emerged to solve the shortcomings of a fragmented multi-chain ecosystem, and unlock the free flow of capital in DeFi and Web3.

Let’s dig deeper.

Now consider an example of many different nations across the world. A nation can choose to either be completely shut off from the outside world, or it can embrace cooperation and trade with other nations. History and the effects of globalization has proven that most nations benefit from trading with other nations in order to balance their strengths and weaknesses. Cross-chain interoperability can be considered in a similar framework.

The need for enabling non-native, or homogenous chains to communicate with one another became the next clear step in the evolution of blockchain interoperability.

What is it?

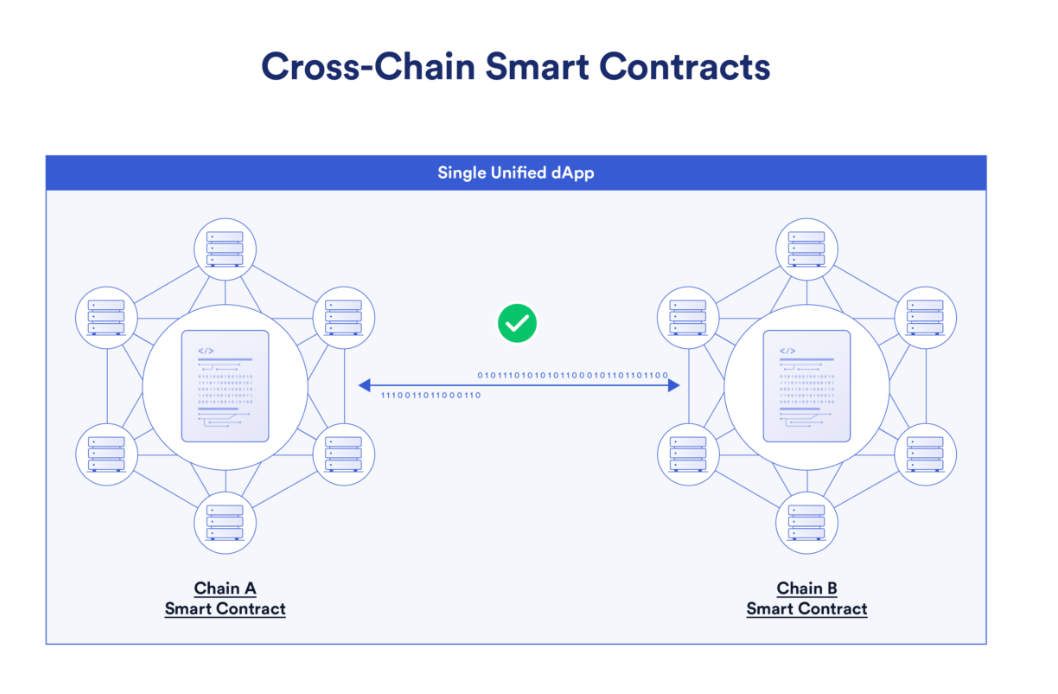

Cross-chain interoperability refers to the exchange of data, whether it be tokens, messages, arbitrary data, or smart contract calls, from source chain A to destination chain B.

In the context of multi-chain interoperability, chains in one network communicate with other supported chains natively using built-in protocols like Cosmos’ IBC or Polkadot’s XCM. However, a Cosmos chain lacks the ability to natively communicate with a Polkadot Parachain. Likewise, an EVM chain (take Ethereum) cannot natively communicate with Solana. As a result, decentralized applications (we call them dApps) must exist in separate “instances” for each blockchain - a super simple way to think about this is how you can have the same video game supported on multiple platforms (PS5, XBOX, PC, etc). It it the same game running on each platform, but entirely isolated from one another. What if all your friends love this game - but can’t play online because you are all on different platforms?

Ultimately, you would need a solution to transfer your inputs cross-platform.

This is how you can think of cross-chain interoperability- the function which allows the XBOX and Sony fanboys to unite, and for a single, underlying video game that players from all backgrounds and platforms can access.

How does it work?

Cross-chain solutions involve two critical steps:

validating the state of the source blockchain

in other words: confirming it is the real blockchain

relaying the data to the destination blockchain

the end goal of interoperability, really

Cross-chain ultimately emerged as a scaling solution for the growing multi-chain world; to enable developers to build applications without worrying about writing additional code for 5+ new chains, letting cross-chain communication protocols handle that burden.

This means a dApp can exist in a single form , and be deployed across different smart contracts, chains, and networks.

Cross-chain: Birth of the Bridge™️

Technically, all cross-chain protocols can be defined as bridges. In the “real world”, bridges are structures which connect one geographic location to another to enable easier transport between them. Blockchain bridges do this for, well, blockchains.

The biggest factor of these bridges is where the trust assumption lies. Scalability is great, but it often comes at the cost of security and performance, as per the infamous Blockchain Trilemma.

An easy way to think about trust in the context of blockchains is : “Who is verifying the system and how much does it take to corrupt them?” Contrary to popular belief, blockchains are not entirely decentralized databases running purely on code and vibes - each chain has a set of validators who verify, validate, and execute transactions on the back-end of the chain. The general belief is that the more validators are involved, the more decentralized a chain is.

Therefore, when using a chain, you are in fact trusting the chain’s validators. Bridges, which are built to offload the difficulty of deploying unique code across different chains for teams, also rely on, or “trust”, validators.

Remember any cross-chain interaction is already trusting the validators of the source and destination chain, by default.

Trusted bridge : A bridge which involves, or “trusts” a third-party to facilitate the transfer of assets and other data across chains. This usually means an intermediary chain with a small set of validators is responsible. These are usually faster by design, but at the cost of security.

Trustless bridge: A bridge which relies on the validators of the source and destination chains to transfer data and value between one another, without additional parties involved. These are designed to be more secure bridges, albeit at the cost of slower performance. Perhaps “trust-minimized” would be a more appropriate way to describe this model.

If you’re curious to dive deeper, I highly recommend reading The Interoperability Trilemma

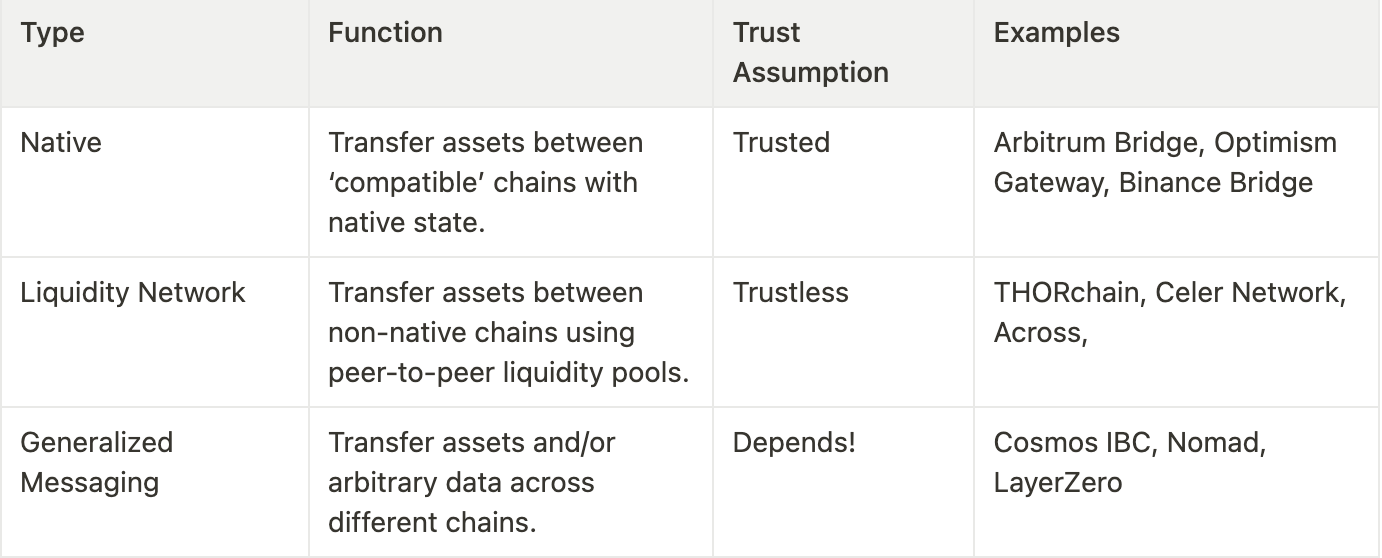

I could go on a whole tangent about bridges, but that’s for a different paper. Generally speaking, however, this bridging 101 cheat sheet from the gigabrains at Li.Fi has a ton of useful resources.

Analysis

Cross-chain interoperability is controversial. It seems like a natural progression for blockchain; enabling chains across different networks to communicate with one another. Less fragmented liquidity, less overhead for developers, users don’t need 20+ wallets and accounts all seem like good things.

Unfortunately, sometimes innovation creates more problems than it solves.

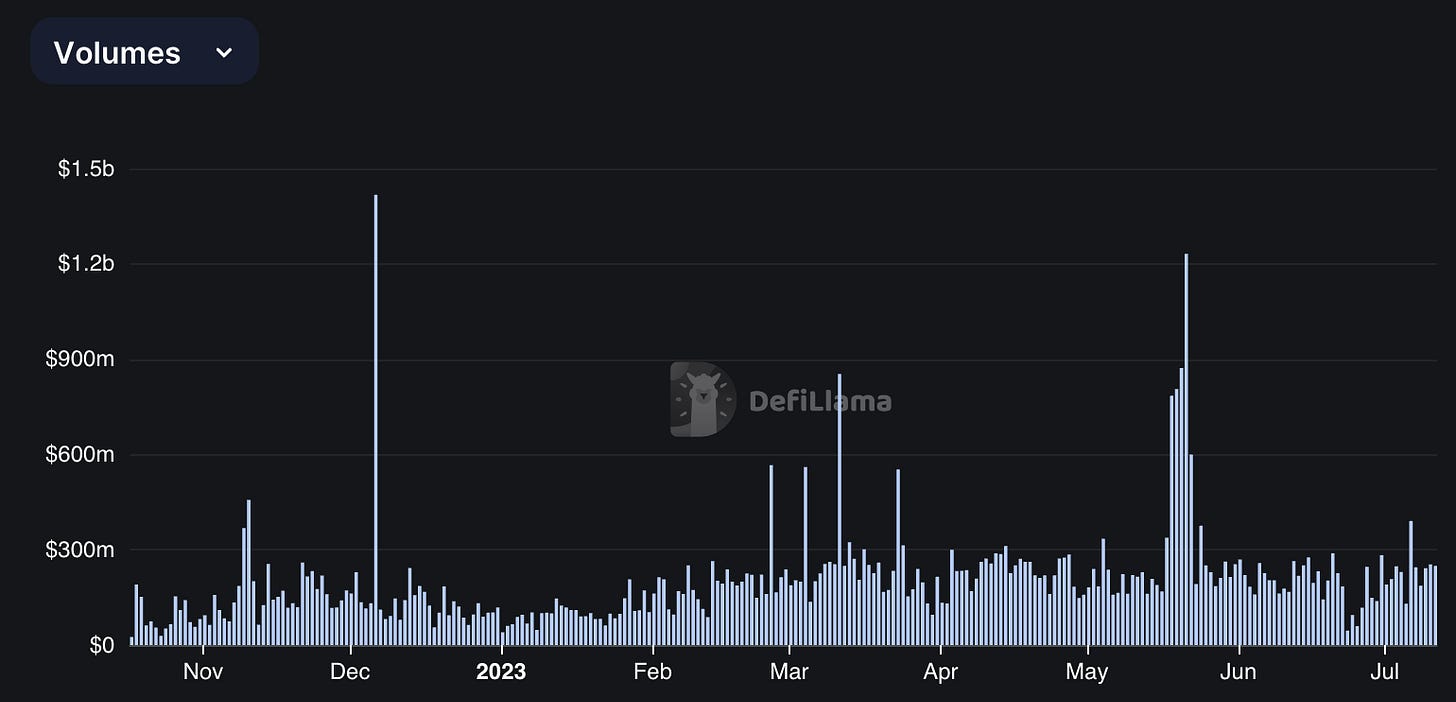

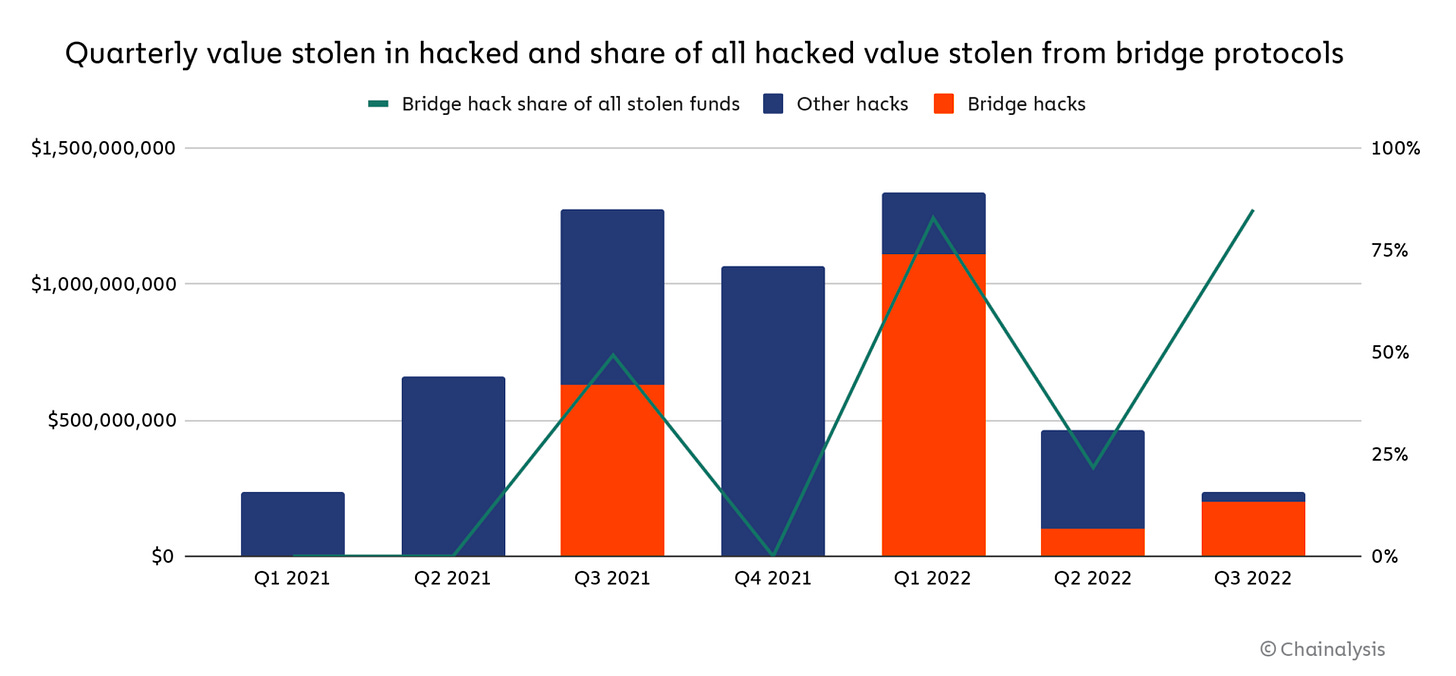

As the multi-chain environment exploded, the need for bridges grew congruently. Bridge volume spiked as people flocked to transfer assets across chains they couldn’t previously use, and TVL soared too.

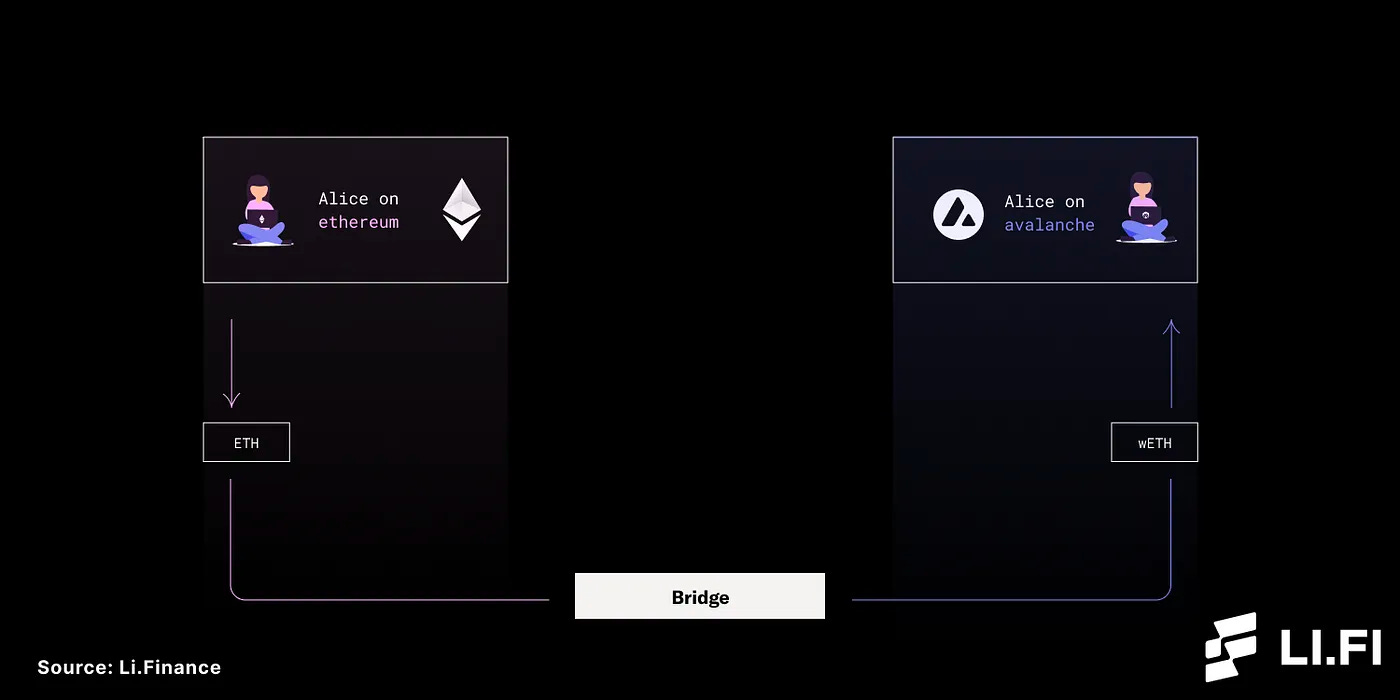

There’s not much room in this paper to go into the details of how these different bridges got hacked, but it is worth pointing a design (flaw) that’s common among bridges, particularly the lock and mint model, which locks native assets and mints wrapped versions. This is because certain assets could not natively exist on certain chains.

Mike wants to transfer 1 ETH from Ethereum to Avalanche

Mike initiates “transfer” on bridge X

Bridge X locks up native 1 ETH in a smart contract, mints “wrapped” ETH in place

Mike receives 1 WETH (imagine slippage/fees aren’t a thing) on Avalanche

This is all fine, but what if the smart contract, which has locked up Mike’s ETH, gets attacked? Mike is left holding his WETH, which he can’t even redeem on Bridge X anymore, while his native 1 ETH is gone in the wind.

This is a simplification, but the idea remains that bridges which follow this model are naturally going to be a target for hackers, and have proven to be so. Ronin , Wormhole, Nomad were all “lock and mint” models, and were the targets of some of the largest attacks in DeFi to date.

Numbers are down in 2023, although Multichain just suffered a $125m attack.

And yet, as Tascha once pointed out, people didn’t really stop bridging after these incidents - a telling sign that perhaps bridges do in fact have their place in DeFi.

While daily volume across Bridges has rarely passed $1b in the past 9 months, it hasn’t totally declined either and remains constant.

Cross-chain interoperability is a work in progress. While asset transfers have been and remain the most popular use of bridges, generalized messaging bridges enable applications to expand the possibilities of cross-chain functionality. This is because they enable the transfer of arbitrary data beyond tokens, opening up possibilities for new innovation such as cross-chain governance, cross-chain lending markets, multi-chain yield strategies, etc.

But trade-offs are to be made.

As Patrick Mccory points out in Bridging Databases (Pt2) , with bridges “our reliance is consistently placed on a set of intermediaries who must vouch for the authenticity of a message sent across the bridge.”

Remember it’s always important to consider where the trust assumption in a bridge lies - who is verifying the system and how costly is it for them to exploit it?

Omnichain : Myth or truth?

This brings me to my last point as we wrap things up. We talked about multi-chain vs cross-chain interoperability, and now there’s a new kid on the block ; “omnichain”. IMO it’s too early to tell if omnichain is a legit concept or just a fancy word for improved multi-chain.

We can use latin prefixes to imply the meaning

multi = many

omni = all

My take on omnichain is that it is a multi-chain world with friction-free interoperability. Protocols like LayerZero are building simple, modular infrastructure for dApps to build on top of, customizing their cross-chain standards to their needs. The easier it is for developers to utilize this technology, the better it is for overall adoption and connectivity of chains. I’m not fully sold on “all” chains though…

Analysis

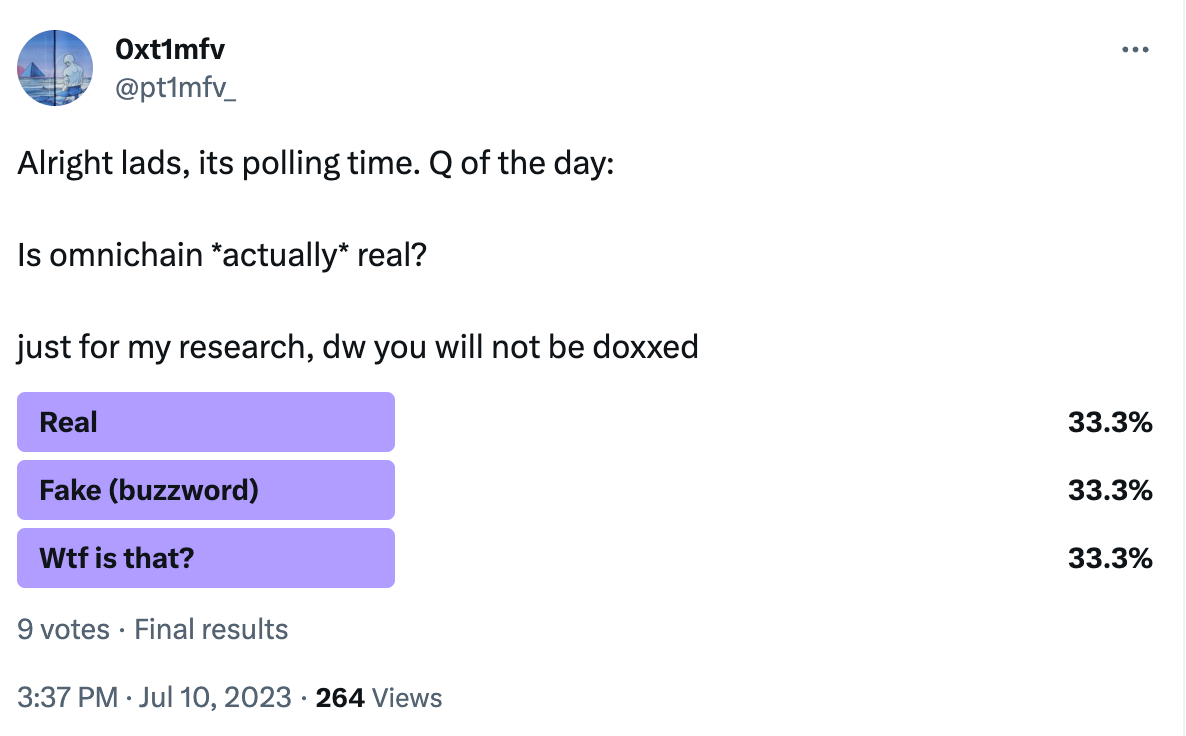

As the results of my viral Twitter poll demonstrate here, there is no clear consensus around whether or not “omnichain is real”. However, seamless blockchain interoperability, where users can zip and zag across chains in one-click, is the natural end goal. If selling the omnichain dream is how we get there so be it.

Conclusion 💭

To wrap up what we learned today;

the multi-chain world was born as a response to Ethereum’s high fees and slow performance, driven by high demand

multi-chain interoperability was innovative but limited, as chains could not communicate with other network chains natively.

cross-chain communication protocols, known as Bridges, emerged to meet this demand, and gained significant popularity at first.

Bridges created new attack vectors, and were the targets of the largest exploits in DeFi to date, demonstrating that cross-chain tech is still immature and needs development. Nonetheless, people still use bridges because there is a natural need for them in the space.

so if we create a multi-chain world where cross-chain communication is frictionless, we get the concept of “omnichain”. this idea falls apart if a major network is left out of the picture, however.

At the end of the day, there is no “winner takes all” here. And why would there be - we simply observed the evolution of interoperability in this paper.

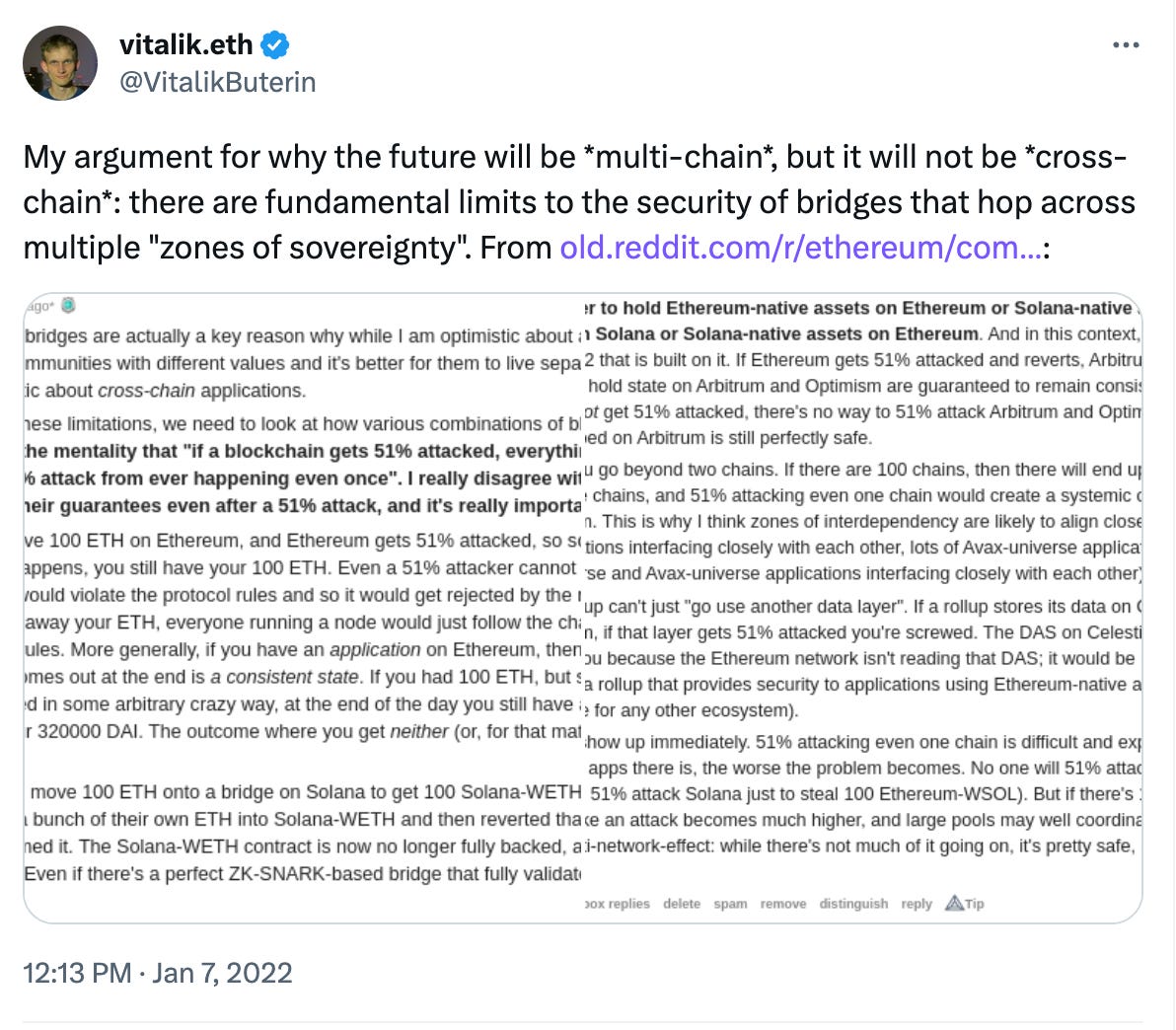

Many people, including Vitalik Buterin, believe that the isolation of networks in a multi-chain world still outweighs the security risks posed by cross-chain bridges. First-gen cross-chain protocols have demonstrated to be a high target of risk.

The demand for bridges, however, demonstrates that most users.. don’t really care? At the end of the day, if you need to bridge you need to bridge.

So the solution comes down to a multi-chain environment with minimal cross-chain friction. It’s time to move away from trust-centric models like Lock and Mint bridges, and pay closer attention to ‘neutral’ models like generalized messaging bridges which can be used to transfer data beyond token transfers and actually expand the usecases for interoperability.

When it comes to adoption, applications which can interact across chains on the backend, keep everything smooth for users on the front end, are winners.

Interoperability teaches us that individual parts are most useful when they come together to form a greater whole. Different blockchains have their own strenghts and weaknesses, but they need to be able to easily communicate and interact with one another. Interoperability is a work in progress, as the issue of trust is still at the heart of cross-chain solutions.

But we’ve taken our first steps to get there, let’s build on the lessons we learned.

Sources 📚

helpful sources for diving deeper into blockchain interoperability

ultimate bridges cheat sheet https://www.researchgate.net/publication/371827225_A_Brief_History_of_Blockchain_Interoperabilityhttps://api-new.whitepaper.io/documents/pdf?id=BJNXW5ZnUhttps://blog.chain.link/cross-chain-vs-multi-chain/https://medium.com/1kxnetwork/blockchain-bridges-5db6afac44f8https://medium.com/stateless-ventures/thoughts-on-interoperability-29ba9969abe6https://blog.connext.network/the-interoperability-trilemma-657c2cf69f17