Reinventing DeFi with The LLAMMA

Looking at the Curve Finance stablecoin and a new lending model for defi

On October 9th, the Curve Finance team published the whitepaper for crvUSD, its highly anticipated stablecoin. While there is no confirmed release date, it’s likely we can expect it sometime in early 2023. Considering the weight of Curve Finance in the defi ecosystem, as well as the we’ll take a look at what we know so far about the crvUSD design and its implications for Curve and defi.

Background: What is Curve Finance?

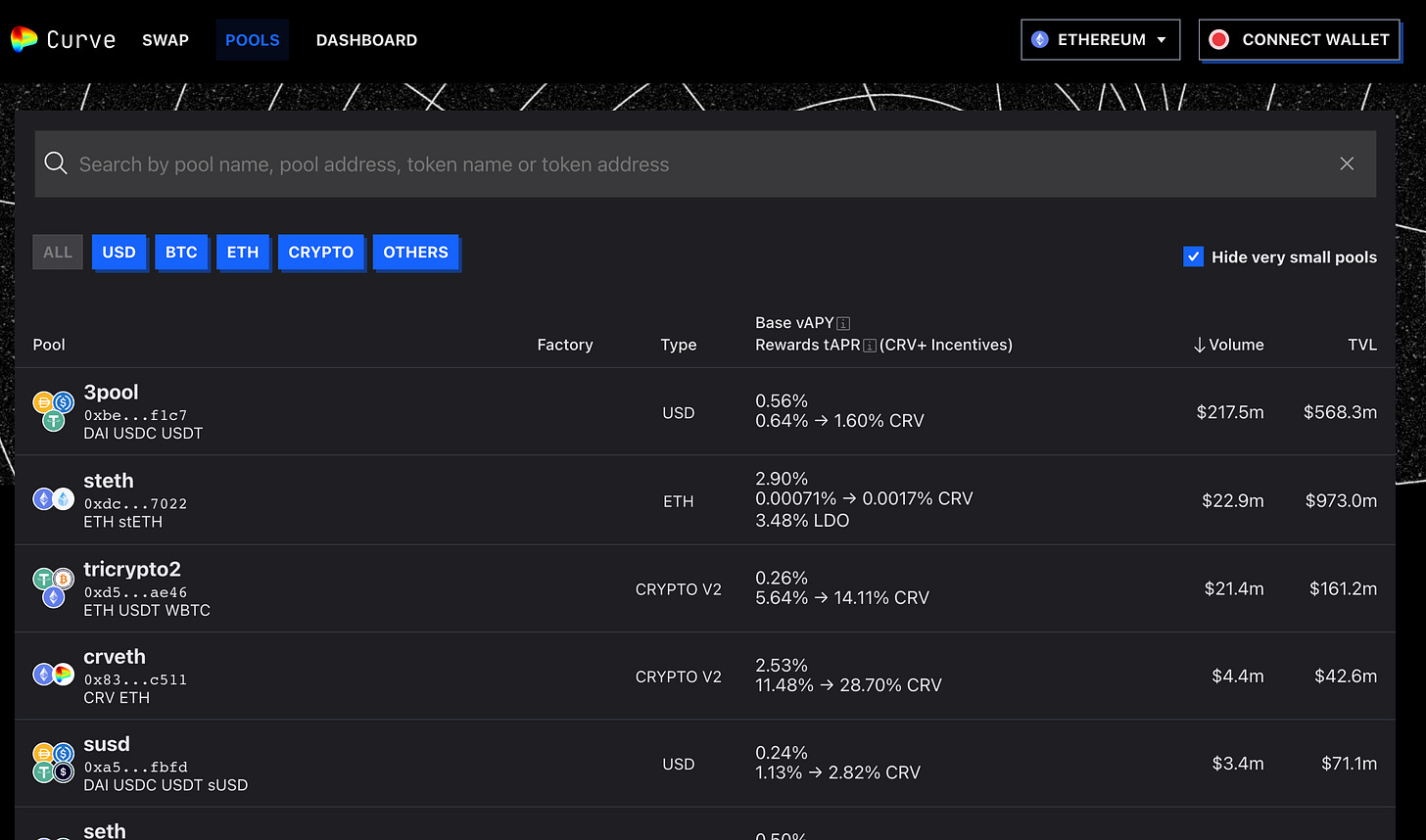

Curve Finance is an automated-market-maker (AMM) , which uses liquidity pools to facilitate trades as opposed to the traditional orderbook method in tradfi. Users can swap between different tokens with low fees and low slippage, and provide liquidity to earn trading fees.

(learn more about AMMs here)Curve v1 was limited to stablecoins only, but non-pegged assets were later introduced in Curve v2.

Curve Finance is the second largest DEX, and has established itself as a blue-chip defi protocol, ranking 4th overall in TVL with $4.7B and $2.48b in volume over the past 7 days. It is also available on a number of chains including Ethereum, Polygon, Arbitrum, Optimism, Avalanche, Fantom, and more.

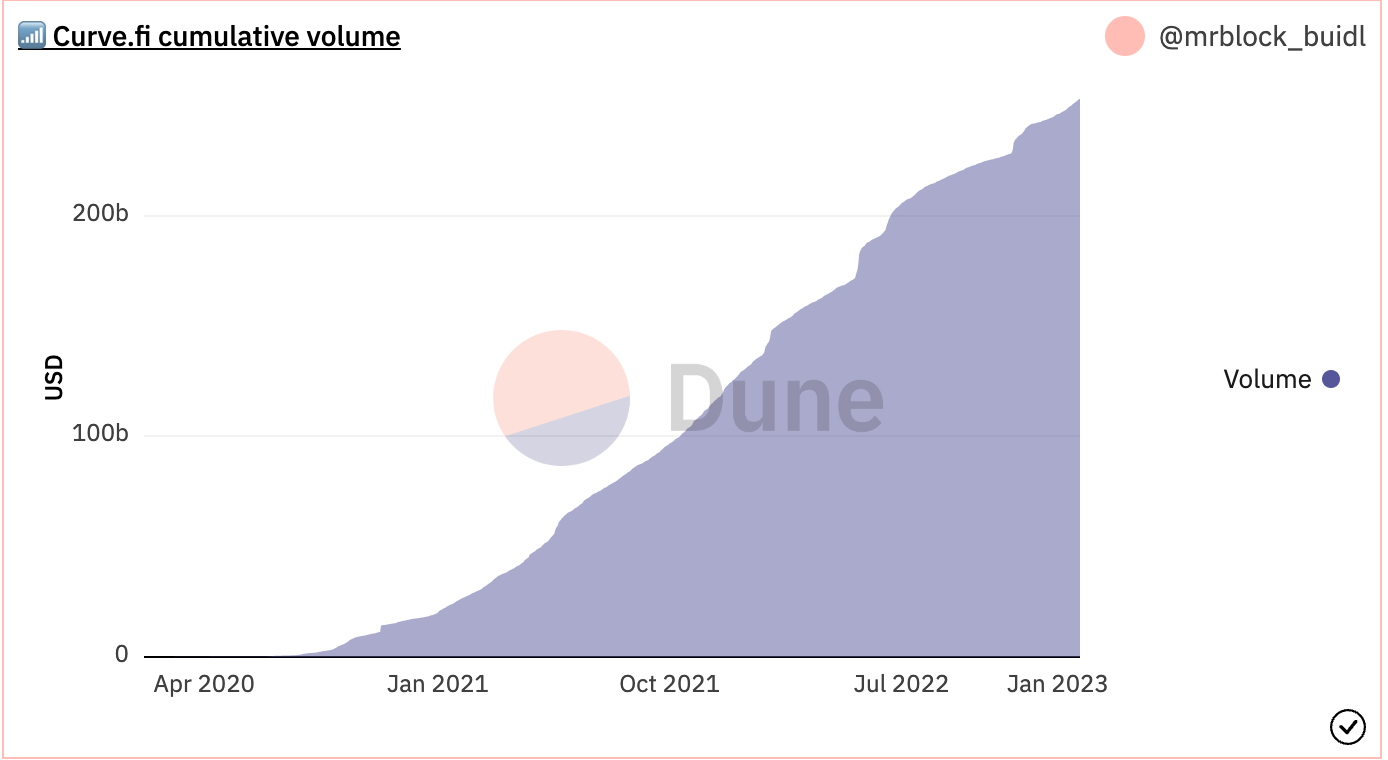

Volume has grown at a steady rate since launch over 2 years ago, and a total of $101,123,195.80 has been earned in fees, according to this Dune Analytics dashboard.

And still, we haven’t seen Curve hit its fullest growth potential. Let’s take a look at the highly anticipated Curve stablecoin and what it entails 👇

What is crvUSD and LLAMMA?

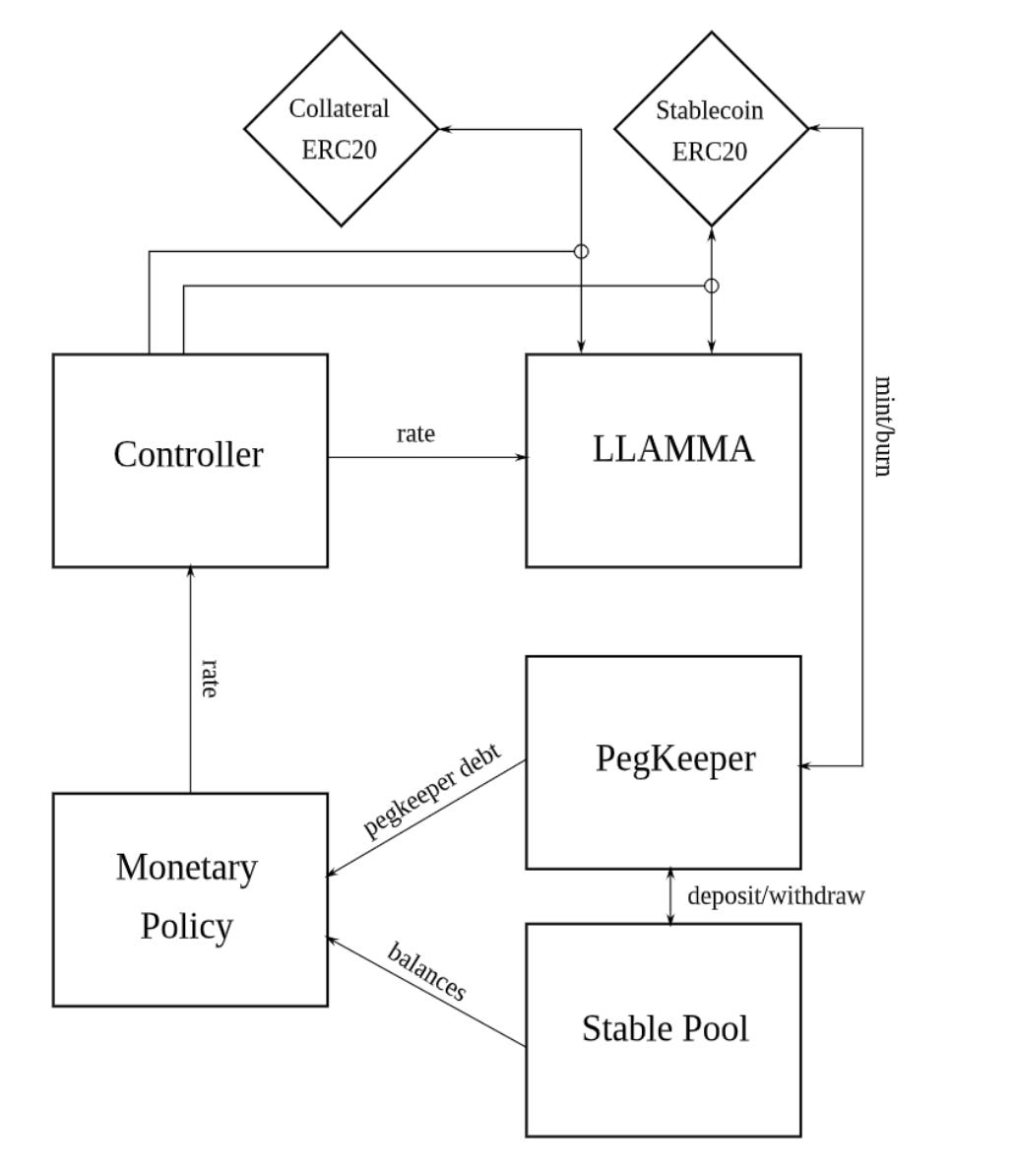

crvUSD will be a decentralized CDP stablecoin, where users borrow it against volatile assets deposited as collateral. However, crvUSD brings a new twist to CDPs, along with several new features to the renown Curve AMM:

LLAMMA

PegKeeper

Monetary Policy

Let’s dig into each one a bit deeper.

LLAMMA: Lending Liquidation AMM Algorithm

At the core of Curve’s stablecoin is the LLAMMA, a new design for AMMs which serves as a hedging solution for borrowing in defi. It introduces a continuous liquidation model which is different from standard liquidation models, which improves capital efficiency all around.

In a standard Collateralized-Debt-Position (CDP) protocol, users borrow stablecoins by depositing non-pegged assets like ETH as collateral. The golden rule is that the value of collateral must be greater than the value borrowed, or overcollateralized.

If the price of ETH rises or stays the same, everything is fine. However, once the price drops, the value of the collateral drops as well, and the position moves closer towards the liquidation threshold. If the position reaches the threshold, it is no longer overcollateralized and gets liquidated. In other words- you lose your ETH.

Although this model has strong benefits, like being programmed to prevent against bad debt, the black and white framework for managing loans has proven to be a pain for many users. After all, most people won’t predict sudden price swings that could completely tank the value of their collateral.

crvUSD intends to fix this through a dynamic liquidation model known as LLAMMA.

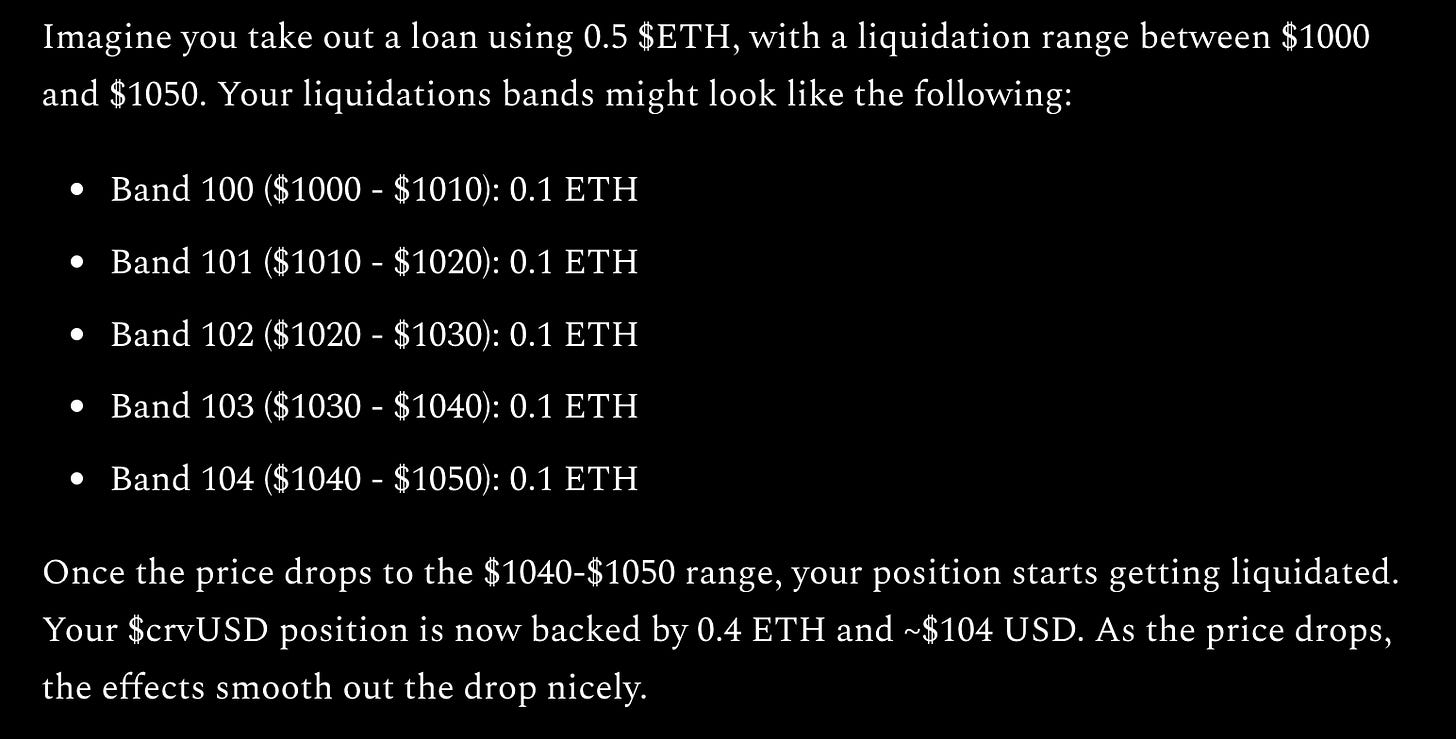

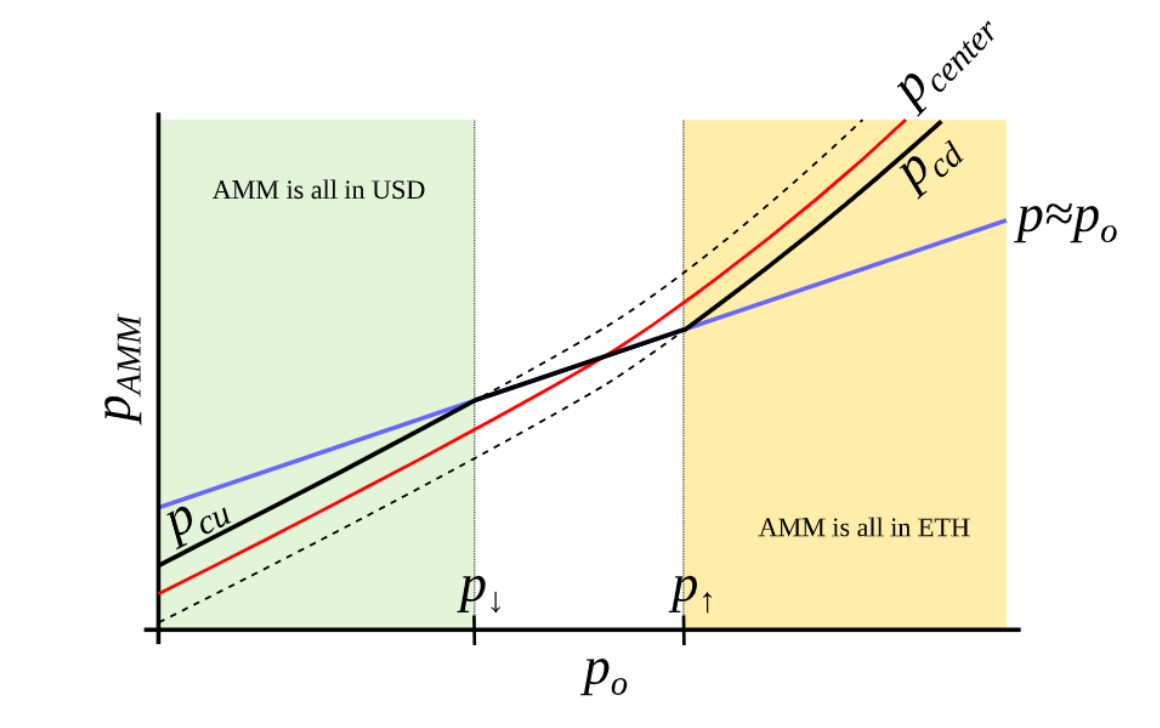

The idea with LLAMMA is simple - the AMM tracks the price of the borrowers’ collateral, and automatically converts users’ collateral into stablecoins based on set price ranges to mitigate losses and risk of liquidation. This isn’t to say liquidations aren’t possible - but they will certainly be easier to prevent.

How it works 🔎

Collateral is deposited in various price ranges, or “bands”

Each band is programmed to maintain a certain amount of asset/USD

The smart contract tracks at which price the collateral was first deposited, and the current price. If the price drops, the AMM converts your position into USD according to the appropriate threshold.

Liquidity must be added to at least 5 bands

Larger ranges mean a sooner liquidation but a gradual process

Shorter ranges are much more prone to sudden changes

An example from curve.substack.com :

Pegkeeper & Monetary Policy

Like the existing AMM, LLAMMA will use Curve liquidity pools as its price oracle. By relying on exponential moving averages to determine the price, Curve is able to mitigate damage onset by sudden price swings, unlike standard CEXs.

This benefits liquidity providers and incentives further use of the platform, and poses a clear usecase for decentralized alternatives (DEXs) to centralized exchanges. (further details around the peg

Can $crvUSD and the LLAMMA be a game-changer for defi?

While it’s difficult to speculate on the erm, financial impact that crvUSD will have on the ecosystem, I believe the soft liquidation model LLAMMA introduces is something that can develop into a strong narrative in defi, especially in the borrow/lending sector.

Though crvUSD will be overcollateralized, the soft liquidation model can be much more attractive for those looking to hedge their loan position against market conditions and may not want to have to continuously top up their collateral, or risk losing it altogether. Not only is this an attractive model for retail, but it can potentially catch the eye of institutions.

What to look for

crvUSD will likely inject more liquidity and volume into Curve and defi as a whole.

My thoughts on potential scenarios to expect:

new liquidity pairs and yield opportunities

$crv will likely generate more fees

potential “buy the rumor, sell the news” event around $crv?

more governance utility for veCRV with the addition of a new ecosystem

new cohort of liquidity providers interested in LLAMMA due to the “soft liquidation” model

potential for institutional capital using LLAMMA for crypto loans as opposed to traditional CDPs

Based on the available info, crvUSD will likely be a big addition to the Curve ecosystem and defi as a whole.

I’d recommend following Curve on Twitter and joining their discord in order to stay up to date on the latest news for crvUSD.