Gm!

I previously wrote about Proof of Reserve and why it’s so important in the crypto industry. It’s a topic that has become increasingly prevalent in recent times, and as the SBF-FTX saga (and now Genesis!) continues its ugly unwind, it’s clear that there are glaring issues the crypto industry needs to address moving forward.

Proof of Reserve is, by default, conducted with merkle tree snapshots (which you can read more about here). These have been the gold standard for good reason; they aggregate a custodian’s total customer balances and reflect the slightest change in value, making them a generally accurate source.

However, looking closer at the details, merkle trees present some significant flaws and loopholes. After all, they only represent a single snapshot of a reserve at a particular moment. Not the inflows and outflows of the assets over time. This means exchanges and other custodians can send/receive assets between one another, then take that particular snapshot and present their reserves.

Off-chain assets and in/outflows are also unaccounted for under this model, besides a third party audit (FTX was audited, btw).

Considering such vulnerabilities, it’s clear that there is a great need for a better alternative.

This week I continued my research, focusing on Chainlink’s take on Proof of Reserve and why I believe it could be the future, for crypto and beyond. Let’s dig in 👇

Chainlink Proof of Reserve : A Better Alternative

TLDR; A proof of reserve standard which embodies the core utility of blockchain technology and Web3: transparency and decentralization. Collateral is audited in real time and verified through cryptographic security using smart contracts.

Chainlink PoR is a game changer for the Web3 ecosystem - and could potentially resonate with TradFi institutions outside the space as well. Reserves can be audited in a simple and effective manner, removing the need to trust various parties and actors on the whereabouts of their depositors’ funds, and instead providing cryptographically secure verification to observe this. Using blockchain technology for what it’s actually meant for. 🧠

To be clear, Chainlink does not perform the actual audit. It is an oracle network, where providing data is the fundamental purpose. Chainlink feeds the offchain data it receives from custodians’ reserves to smart contracts which are built to verify the reserve.

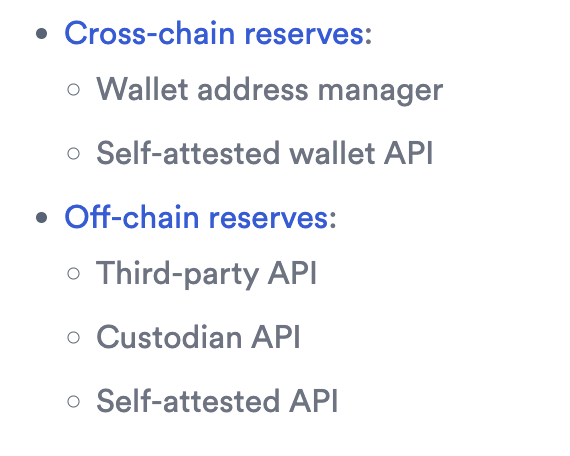

Institutions looking to utilize Chainlink PoR can choose between using cross-chain reserves or off-chain reserves, as Chainlink is able to work with both. Read more on how each data feed works here.

Chainlink PoR Applications

Stablecoin reserves

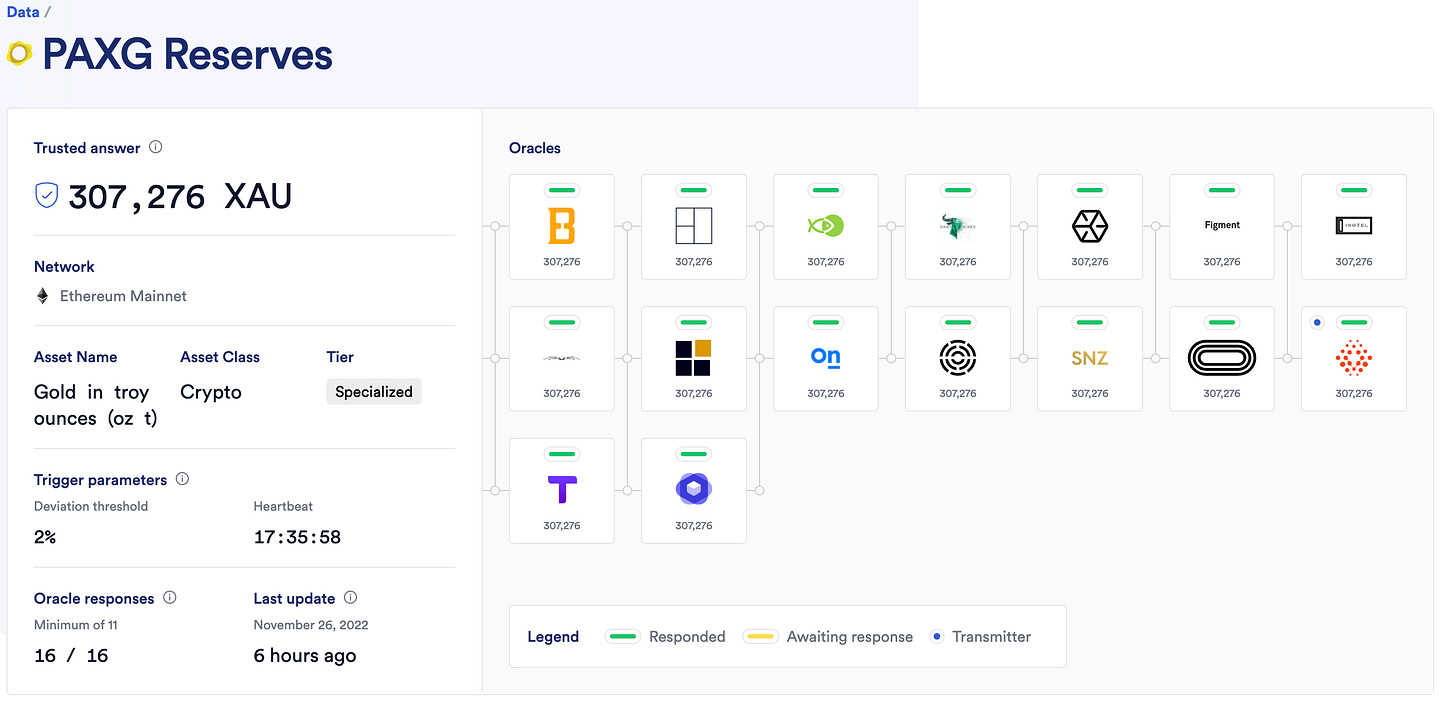

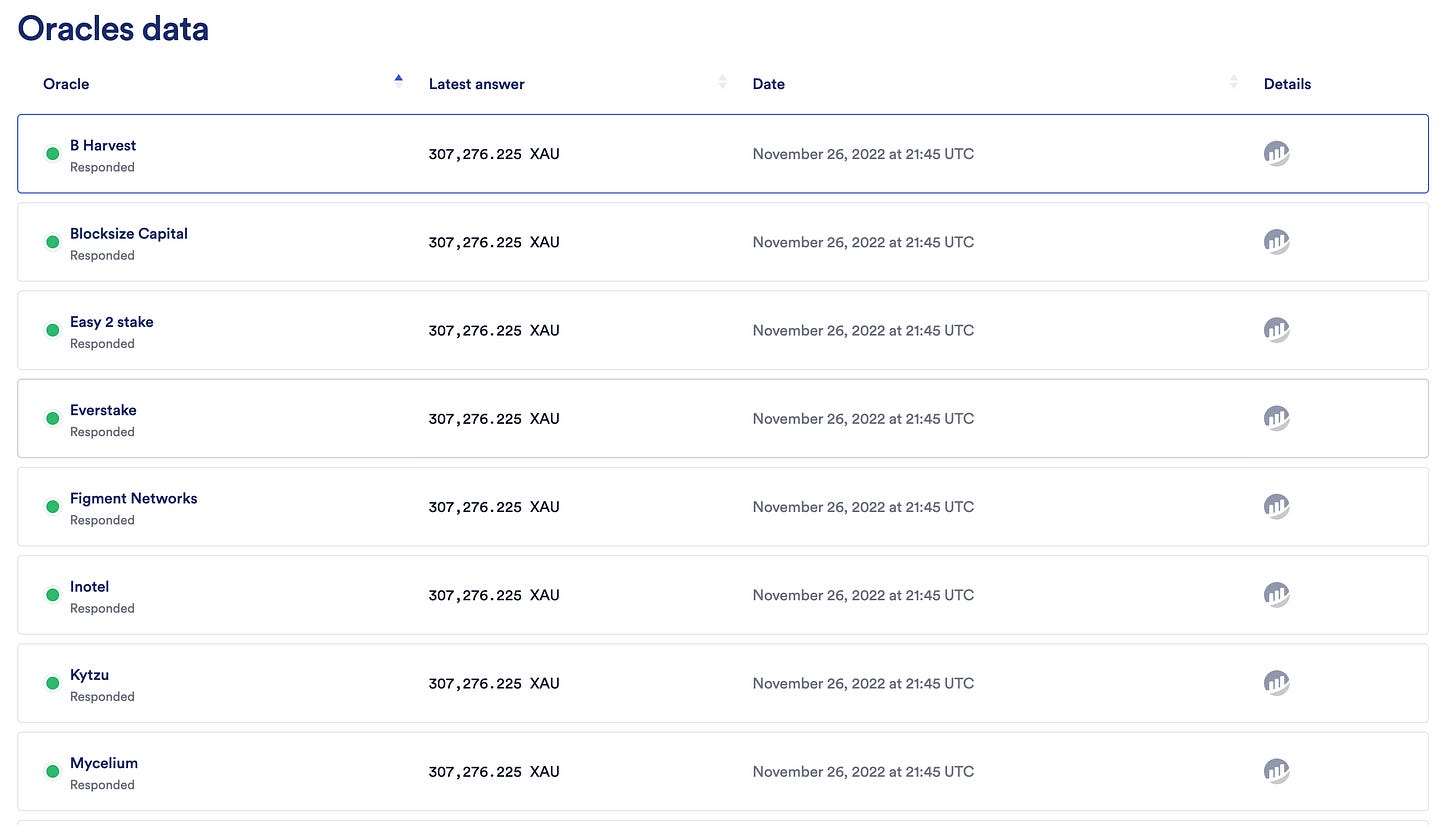

For fiat-backed stablecoins like Circle’s USDC or Tether’s USDT, Chainlink PoR can be used to ensure there is sufficient collateral in their off-chain reserves, which in turn helps build trust in the actual stability of stablecoins. One example is Paxos’ PAXG reserves.

You can even access the latest ‘proofs’ requested and the answer determined (all on Etherscan).

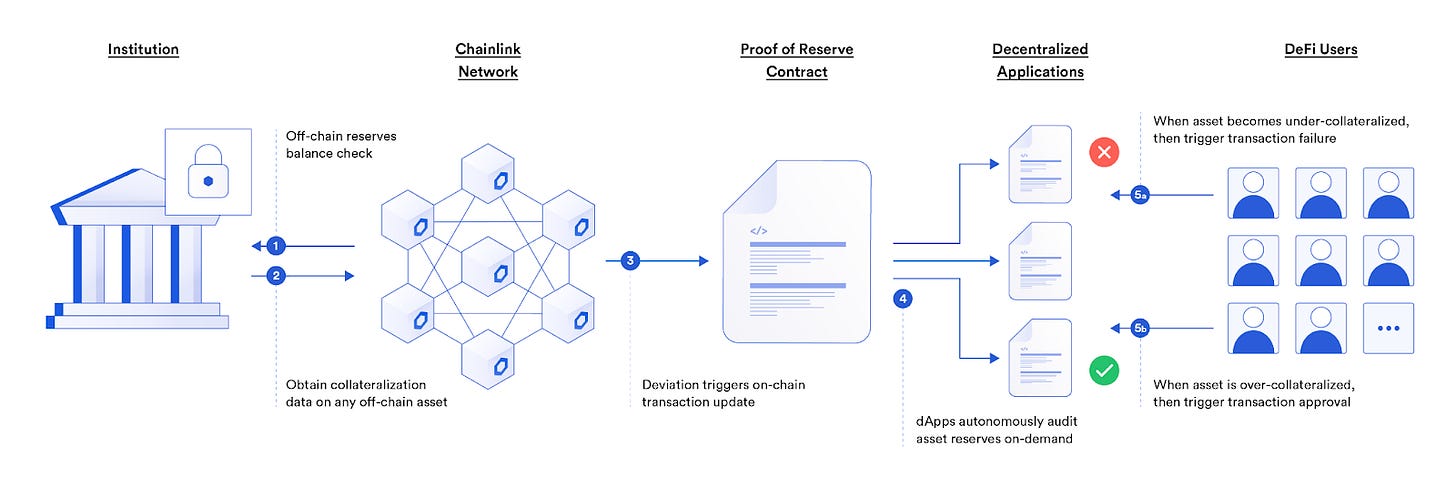

Breakdown: A financial custodian (eg Circle) will provide an audit firm with financial statements verifying their fiat/commodity reserve for USDC. Chainlink accesses this off-chain data and feeds it into smart contracts which can be deployed by DeFi apps (eg Aave) on-demand . These dApps verify the reserves, and can safely allow transactions with the stablecoin to resume on their platform (Or discontinue them if the reserves are insolvent).

Cross-Chain Assets

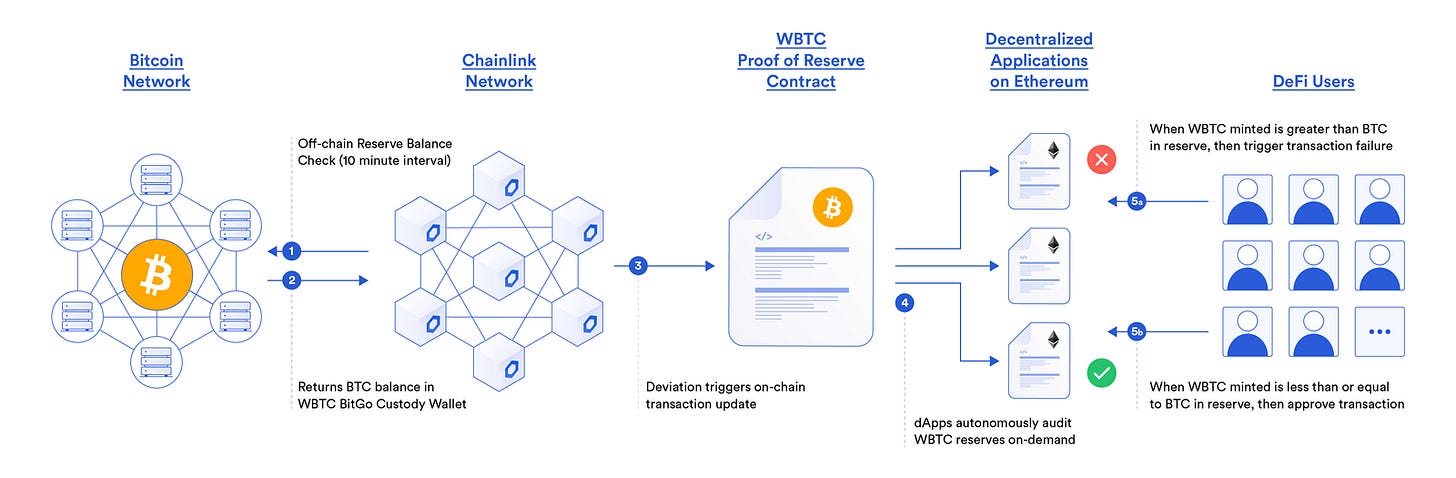

The ‘Blockchain-Agnostic’ nature of Chainlink allows for collateralization data on any cross-chain asset, on any chain. Take wrapped Bitcoin, for example. Every 10 minutes, Chainlink oracles verify a custodian’s BTC balance and provide an immediate update to its data feeds once there is any deviation in balance. This is important for avoiding risk associated with undercollateralization of these assets, and helps those with BTC-denominated loans.

Real World Assets

The cool thing about Chainlink PoR is the fact that it goes beyond crypto - it also provides a strong usecase for tokenized ‘real world’ assets, such as real estate. The shady nature of these assets’ verification is a barrier to adoption, but with Chainlink PoR this process can be made cryptographically secure.

Once again, the process is simple. Chainlink accesses offchain information such as the property ownership and escrowed bank account, and feeds this data on-chain. The data can be verified through smart contracts using Chainlink data feeds, and protocols can mint tokenized assets to accurately represent ownership of that particular asset.

Tradfi

Traditional financial institutions (ie banks) can use Chainlink PoR to build trust and legitimacy with their customers/depositors. Imagine how differently 2008 could have gone if those banks were being audited and people realized that their investments were being gambled against.

The Current State of Things

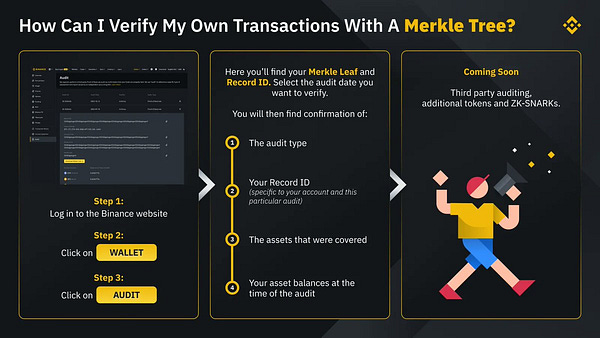

Binance announces a new feature on its platform, which will allow users to log in and conduct their own proof of reserve using merkle tree snapshots.

This isn’t entirely a bad thing for retail users, but going back to my earlier point about exchanges moving assets around between each other - we need to move beyond relying solely on merkle trees.

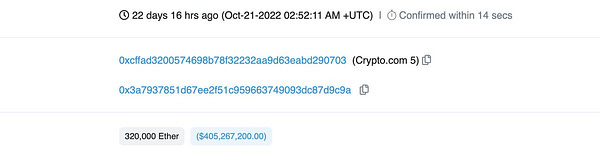

Crypto.com has found itself involved in some controversy as well, after joining the wave of exchanges uploading their proof of reserve to Nansen.

In addition to holding more SHIB than ETH (18.49% vs 11.88%), it was revealed through on-chain analysis that they had sent 320K ETH to Gate.io, another fellow exchange, and received only 285k back. Seems like a pretty bad deal to me.

Apparently it was just sent to the wrong address, and no wrongdoing was officially confirmed (even though 35k ETH is missing), but this is an example of how proof of reserve via merkle tree snapshots can be manipulated.

Exchanges and other custodians can help each other out by sending assets back and forth whilst using them to present their reserve.

If you needed a reminder of why it’s so important to hold CeFi custodians and entities accountable, Grayscale, in light of recent events, refuses to provide proof of reserve for their assets “due to security concerns''. The largest legal custodian of BTC. Can’t make this up.

Closing Thoughts

I’ve gotta be honest, I’m finding very few (if any at all) reasons that Chainlink’s Proof of Reserve model does not become the industry standard. It’s time that the crypto industry, which has been preaching about transparency and decentralization, puts its money where its mouth is.

It’s time to get rid of the blackbox.

The future is still looking bright for Chainlink PoR.

You can view all the protocols and apps who have integrated Chainlink’s PoR here. Some notable names from the list include Gemini, Bitgo, and Ren Protocol. Huobi is also set to join that list soon, recently announcing its adoption of Chainlink PoR to provide transparency around HBTC reserves - namely offchain resources.

28 projects is too little in my opinion, and I hope to see that number grow steadily over time. I’ve gotta be honest, I’m finding very few (if any at all) reasons that Chainlink’s Proof of Reserve model does not become the industry standard. It’s time that the crypto industry, which has been preaching about transparency and decentralization, puts its money where its mouth is.