Notes: Congress vs FTX

Congress hearings are boring, so skip the hours of video and catch up on all you need to know in 5 mins.

Last week, Congress held two hearings to investigate FTX’s collapse- The House's Committee on Financial Services, and the Senate Banking Committee's Hearing. Both hearings felt like watching a movie, with a cast of top-rated actors confidently delivering uninformed narratives about crypto.

Few people can actually watch an entire congress hearing, so here’s the highlights (disclaimer: these are notes not an article)

John Ray III

FTX had: complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here

they were USING QUICKBOOKS for record keeping

nothing against quickbooks, just not suitable for a multi-billion dollar company.

employee/company invoices done via Slack and other social mediums

the crime itself was not sophisticated - taking customer funds and using it for your own purposes. it was simply done in a sophisticated and obscure manner by intelligent sophisticated minds.

Regarding the independence between FTX and Alameda Research?

Little to none.

"The operations of the FTX group were not segregated; it was really operated as one company,"

There was "no distinction" between FTX and Alameda Research in terms of independent boards, personnel, etc

Kevin O’Leary

What exactly went wrong for FTX? (Pat Toomey)

TLDR; CZ and Binance is responsible for the downfall of FTX

He kept asking “where is my money” but none of the executives at FTX would tell him, so he decided to call up Sam himself.

Sam told Kevin about a transaction involving CZ gaining 20% ownership of FTX via FTT.

THERE WAS A DISAGREEMENT BETWEEN CZ AND SAM SO CZ SET OUT TO TAKE HIM DOWN 😤

Binance didnt’ get licensing & regulatory approval in various jurisdictions because CZ withheld valuable data from regulators! (according to Sam lol)

Sam/FTX only choice was to buy out CZ’s 20% (which was apparently worth ~$32b??)

Obviously this takes a huge hit on the balance sheet, and it all goes downhill from there.

YOU ASK ME WHY THEY WENT BANKRUPT?? CZ was blasting his $500m FTT sell on Twitter, obviously to feed the fire and unleash chaos.

“Why would [CZ] put that info out there? Every trader knows if you have a large block trade to make, you discreetly negotiate with other traders in the market.”

“These two behemoths of the crypto industry were at war with each other, and one put the other out of business.”

And now Binance is a large unregulated monopoly sitting at the top of the mountain.

I’m not even a Binance user and I don’t care much for CZ but, it’s really interesting how O’Leary pivoted the entire narrative away from SBF’s fraud and wrongdoing, towards ruthless business competition which he claims to be borderline unethical. Wonder if it has anything to do with getting his $15m FTX spokesperson bag. back.

Cue Elizabeth Warren and the fear mongering:

(to O’Leary) Do you believe the potential benefits of crypto are SO promising that we should accept WEAKER ANTI MONEY LAUNDERING RULES AND WEAKER COMPLIANCE for these crypto firms, as opposed to banks, brokers, and western union?

K: No it’s not complicated

dummy, we just have to apply all the same regulatory structure we apply for these institutions and existing stocks and bonds.I take issue with this idea that crypto regulations would weaken anti money laundering. Currencies, including USD, have been used for that stuff for decades now. No one’s hands are clean and this is an outdated argument 💯

If you know your clients on both sides (through KYC) and use a regulated crypto like USDC, you solve this (money laundering) problem overnight!

I like the optimism Kevin, but you can’t fit a square peg into a round hole; applying the same ancient regulatory structure from tradfi to crypto is not exactly going to work.

Ms. Cortez Masto

What is your take on an earlier proposal (instead of outright banning crypto) to isolate crypto assets from markets entirely and treat them all as securities?

K: As an investor, I would be SHORT USD BANK STOCK. if we created a legislation which restricted banks from integrating cryptocurrency and crypto technology.

The benefits of crypto in banking systems: improvements in cost, efficiency, audit-ability, productivity. Look at archaic practices like ACH transfers or the Fed wire and how much better those can be.

Isolating crypto from banking system is INSANITY!

Okay Mr Wonderful, good point there.

Jennifer Schulp

I too would not isolate crypto from regular markets and classify them all as securities

On that point, (if I were queen of crypto regulation for a day) I would ask SEC to provide crystal clear guidelines for what constitutes a security in crypto (aside from the archaic Howey test)

While a lot of crypto assets do count as securities, in my opinion, a lot of them don’t, and it is crucial to make that distinction abundantly clear.

I would ask congress to clearly define the roles of the CFTC and SEC in regulating the space.

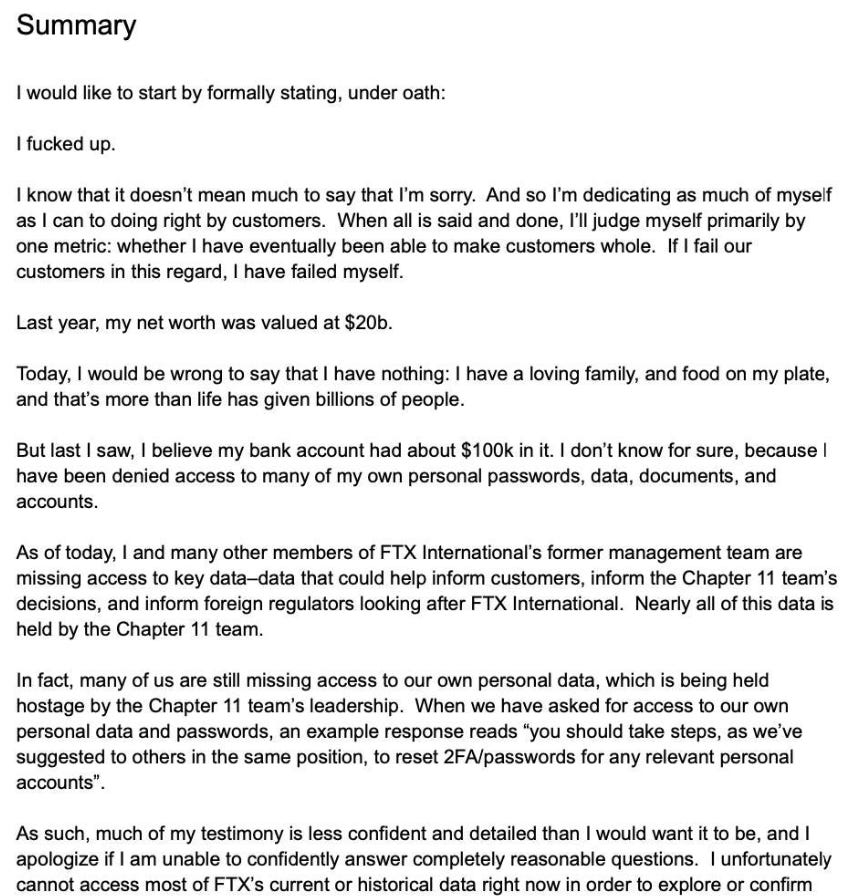

SBF needs to work on his PR skills.

Rep. Emanuel Cleaver also pointed out the unprofessional nature of Sam’s testimony to congress, which begins with “I fucked up”

I’m not an expert or anything, but I don’t think thats how you talk to an already angry congress.