Bridging the Interoperability Gap: The Ultimate Guide to Altitude DeFi

A deep-dive of Altitude DeFi, an omnichain bridging solution built on top of LayerZero

Disclaimer for all you degens: This is not financial advice of any kind. This research is intended purely for educational purposes. Always DYOR when interacting with DeFi protocols and be aware of the risks you are assuming beforehand. Please note this article is sponsored by Altitude DeFi.

Contents

🖼️ Background

🌉 The Current State of Bridges

🛠️ How Altitude works

💭 Closing Thoughts: Why Altitude?

Background

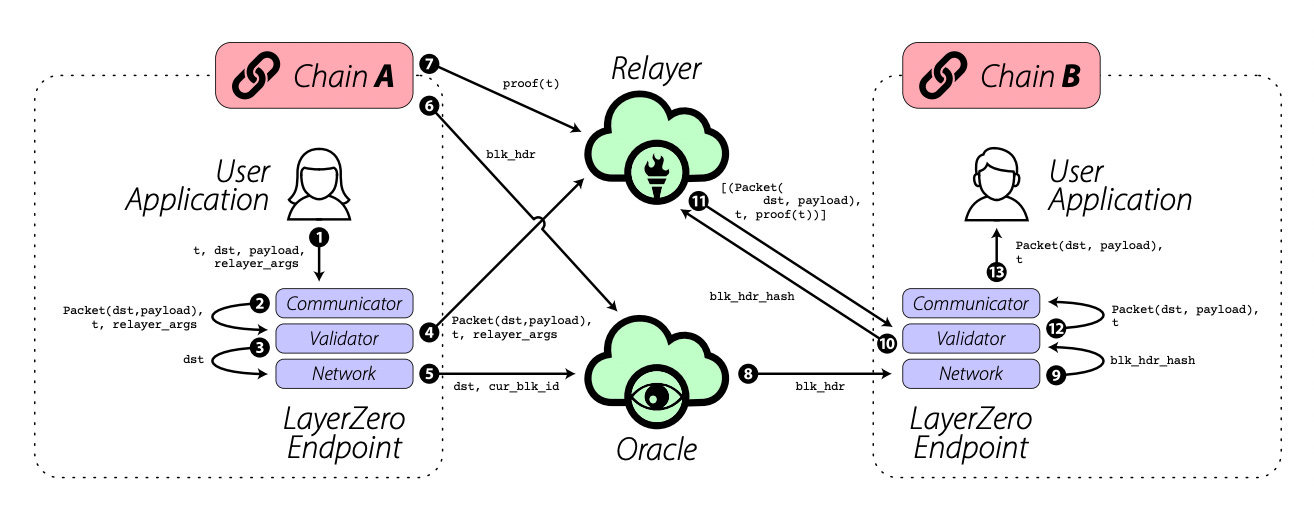

Altitude DeFi is a composable native bridging solution for blue chip crypto assets, built on top of LayerZero. Altitude aims to solve the hardships of today’s briding protocols and deliver a seamless and secure crosschain experience by utilizing liquidity pools across different chains and taking advantage of LayerZero’s messaging infrastructure.

Blockchain interoperability is one of the most important milestones for blockchain technology and the web3 ecosystem. Computers and computer applications didn’t reach their fullest potential until there was a way to allow communication between them via the internet, and blockchain networks won’t reach their fullest potential until there is a way to seamlessly communicate with other networks.

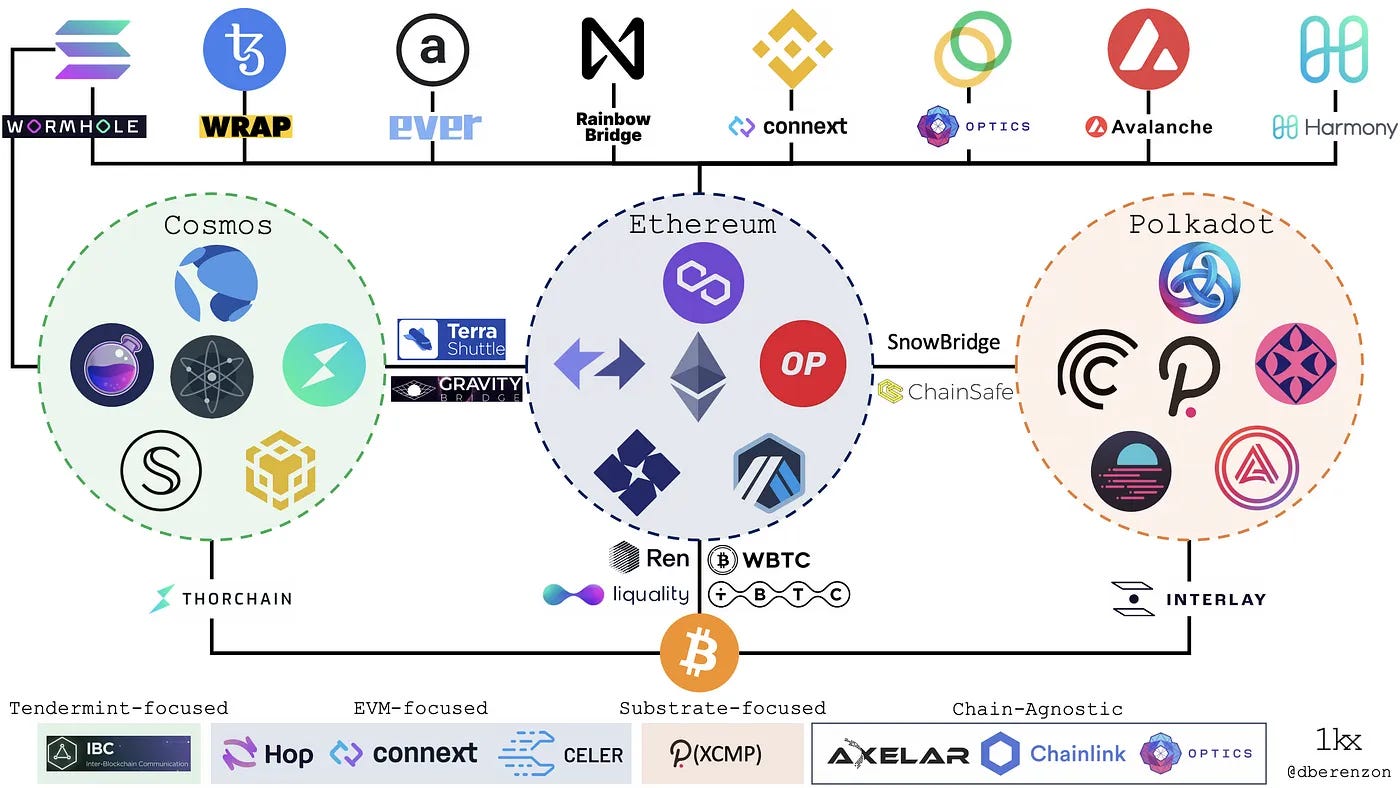

The idea for building Cross-chain interoperability solutions has been around since the early days of crypto, pioneered by protocols like Cosmos and Polkadot. Cross chain solutions include bridges and atomic swaps, oracles, and sidechains. As significant as these breakthroughs have been for crypto, limitations arise, such as the fact that Ethereum only supports cross-chain interoperability for EVM compatible chains, which poses its own set of risks which will be touched on later on.

LayerZero built a solution for these limitations, known as Omnichain interoperability. By allowing protocols and chains to send lightweight messages to one another with gas efficient smart contracts, this breakthrough allows for communication between EVM and non-EVM chains and opens up a new world of opportunity in Web3.

Stargate Finance was the first application built on top of LayerZero, and the first omnichain bridging solution of its kind - utilizing stablecoin liquidity pools across different chains to allow users to swap stablecoins without the need for wrapping their tokens.

And now, Altitude has built an omnichain solution for bridging your favorite blue chip crypto assets.

for more on cross chain, omnichain, and bridges read here

TLDR : Altitude’s main USPs

✅ Easy to bridge and use native assets cross-chain

🔐 Safely bridging assets with Secured Guaranteed Finality

💰 Cheap bridging fees

📈 Reduced risk of Impermanent Loss

🏎️ Fast transaction speeds

We’ll be jumping into each of these aspects in this research paper. So get comfy - we got some unpacking to do 👨🔧

The Current State of Bridges (And Why A Solution Is Needed)

As mentioned earlier, interoperability is a crucial milestone for blockchains to reach their fullest potential, and bridges are the most relevant usecase for interoperability.

However, any crypto user familiar with bridges could recognize that the current state of bridges is just not cutting it for the long term.

If you are unfamiliar with crypto bridges, here is a great thread to familiarize yourself with the basics:

Bridges nowadays are expensive, slow, and more importantly not secure. They have been the targets of major exploits, and fees are often frustratingly high on most bridges.

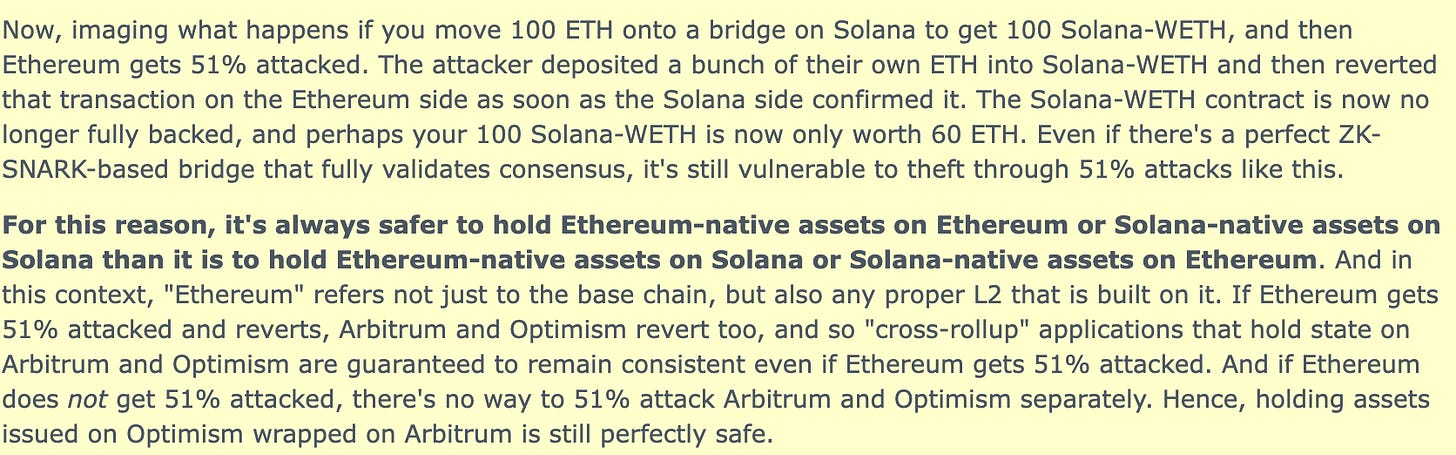

Vitalik pointed out the limitations of cross chain applications, most notably the underlying risk associated with using wrapped assets in a reddit post :

Read about the Nomad bridge hack, which resulted in a loss of $190,00,000 :

or the wormhole hack for $326,000,000

or the Ronin hack worth $615,000,000: https://www.cnbc.com/2022/03/29/hackers-steal-over-615-million-from-network-running-axie-infinity.html

That’s over $1B in assets stolen in 2022 alone!

So what’s there to be done? Bridges pose a lot of risk, but at the end of the day users still need to transfer their crypto assets from one chain to another.

Enter Altitude ⛰️

This is where Altitude DeFi comes in.

Altitude’s vision is to develop a smooth and convenient omnichain experience for defi users that is safe and reliable.

Current omnichain bridging solutions, most notably Stargate Finance, cater exclusively towards stablecoin swaps. While these are significant in themselves, stablecoins still only represent a small portion of the entire crypto market.

Stablecoin market cap: $135.48b

Crypto Market Cap: $1.15t

There is a clear need for a cheaper and safer bridge to transfer blue chip assets across different chains. Let’s examine how Altitude is building a solution for this 👇

Mechanics: How does Altitude Work? 🔎

Bridging with Altitude

The core function of Altitude is bridging. Let’s break down how this works on the protocol with an example:

user initiates a transfer of $100 ETH from mainnet to Arbitrum

Altitude calls the LayerZero contract, moving the information of the $100 transfer from mainnet > Abritrum

The contract ensures there is sufficient liquidity on the destination chain (Arbitrum) to successfully execute the transfer

Altitude holds the $100 on the executing chain (mainnet) until the swap has been confirmed by LayerZero on the destination chain (Arbitrum)

Once confirmed, Altitude distributes the $100 in ETH from the mainnet liquidity pool to the Arbitrum liquidity pool

While this sounds like a lot at first, the process can be summarized rather simply:

Within 2 transactions:

📞 The protocol calls the LayerZero contract, moving the information of the swap amount from execution chain ➡️ destination chain

✅ Altitude distributes that amount on the target chain (if successful)

This process creates a safeguard for ensuring sufficient liquidity on the destination chain, and allows Altitude to provide users with non-wrapped assets on their destination chain.

This is possible due to chain paths 👇

Chain Paths and Liquidity Pools

One of the key advantages of Altitude’s bridging process is that users receive and exchange native assets on the destination chain. This is made possible due to the use of liquidity pools and LayerZero chain paths.

Chain paths allow direct connections for a single asset between two different chains.

A liquidity pool is created for a specific asset on each chain and references another liquidity pool. This renders the chain paths independent, as it is only the two liquidity pools referencing one another. This mitigates risk and maximizes resiliency for the protocol and users in the case of chain outages.

An example:

how an Arbitrum > Optimism chain path works

liquidity pool of $ETH on Arbitrum

liquidity pool of $ETH on Optimism

When executing a transfer ETH from Arbitrum to Optimism, the liquidity pool from Arbitrum directly references the liquidity pool from Optimism.

To summarize on chain paths:

a direct connection is formed between two different chains for a single asset

a liquidity pool is created for a specific asset and references another LP for transferring asset using this connection

To dive deeper into chain paths, read more in the layerzero whitepaper https://layerzero.network/pdf/LayerZero_Whitepaper_Release.pdf)

Security 🔐

One of Altitude’s main strengths is their innovative approach to cross-chain security.

Introducing The HUB

The HUB is an Ethereum-based router built for connecting each chain path to the corresponding chain. Since one liquidity pool can only reference one other liquidity pool during a bridging transaction, chain paths are independent of one another.

This helps protect the protocol and its users against chain outages, by reducing the centralization risk you would have in a unified liquidity pool system. This is another way Altitude can significantly improve the user experience of bridging.

Secured Guaranteed Finality

As explained above, Altitude executes bridging transfers using 2 transactions in a process called Secured Guaranteed Finality. This refers to the protocol ensuring sufficient liquidity on the destination chain before bridging assets.

This is important because it prevents the risk of users getting funds stuck one chain and not being able to successfully transfer back if needed. Nothing is worse than, well, being stuck.

Unlike Stargate’s Instant Guaranteed Finality model, which guarantees liquidity on the destination chain only once the transaction has been confirmed, users bridging with Altitude will have control over their assets during the bridging process.

As explained earlier, when a user initiates a transfer, Altitude holds the user’ funds on the source chain while it calls the liquidity pool on the destination chain. This means that users are able to revoke a transaction and keep their funds if they need to.

Altitude’s security model is a big step for decentralizing the bridging sector in crypto. Projects don’t need large amounts of liquidity to bridge assets - Altitude can support the bridging of any native asset between any two chains using chain paths.

Obvious to keep in mind here that this is referencing the future - Altitude will launch initially with a preset list of supported networks/assets.

Liquidity Pools and Farming 🚜

Complementary to its native bridging solution, Altitude will also allow users to support the protocol by providing liquidity for supported network assets. Users can deposit into Altitude’s single-sided liquidity pools and earn yield by farming their LP tokens.

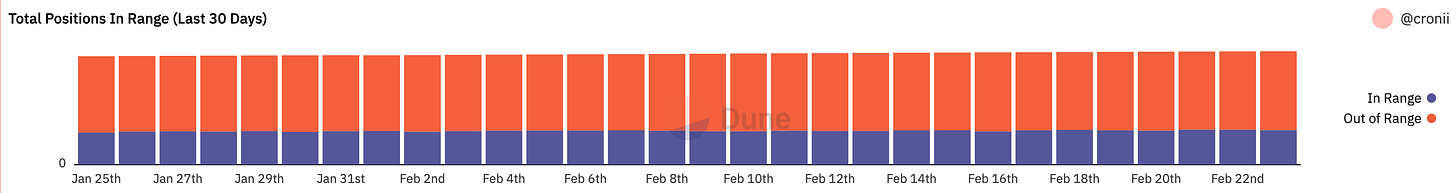

With traditional AMMs, providing liquidty requires the use of two assets in a 50:50 ratio. This exposes users to the risk of Impermanent Loss , as they must account for the congruent price movement of two assets. Onchain data demonstrates just how unprofitable this is for most users:

Single-sided liquidity pools remove the risk of impermanent loss, since there is no 50:50 ratio to maintain. User’s don’t need to be attached to their screen monitoring the slightest price movements to stay “in range”

Similar to a liquidity pool on an AMM, users who provide liquidity receive an LP Token congruent to their share of ownership in the liquidity pool.

Users will ALWAYS be able to redeem their LP tokens and reclaim liquidity (aka withdraw funds)

✅ With sufficient liquidity, users can redeem LP tokens from either liquidity pool

❌ With insufficient liquidity, LP tokens can be redeemed across chain.

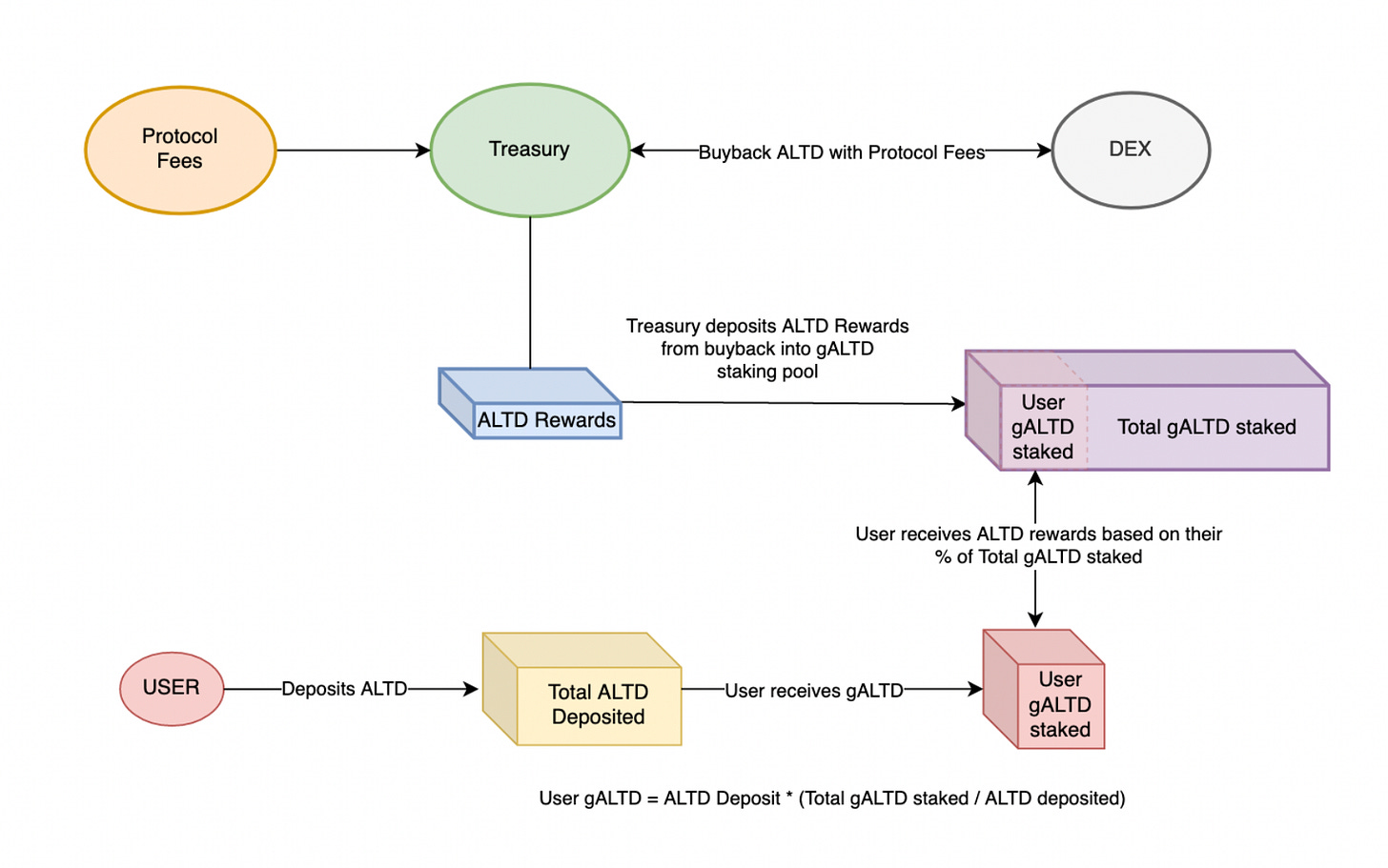

The LP token can be used to reclaim liquidity (get your funds back) or to participate in Altitude staking to earn yield. Those who stake with Altitude will receive rewards in $ALTD, the protocol token.

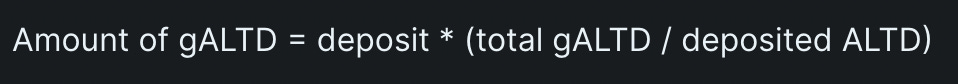

In addition, users can also stake their $ALTD to receive $gALTD, which will allow for governance voting in the future. The amount of gALTD received will be determined by this formula:

This ensures that rewards are distributed for eligible periods. Only gALTD holders will be able to participate in governance voting.

This diagram represents how ALTD/gALTD will be distributed to stakers:

Wait up, ALTD? gALTD? What’s this?

ALTD Token

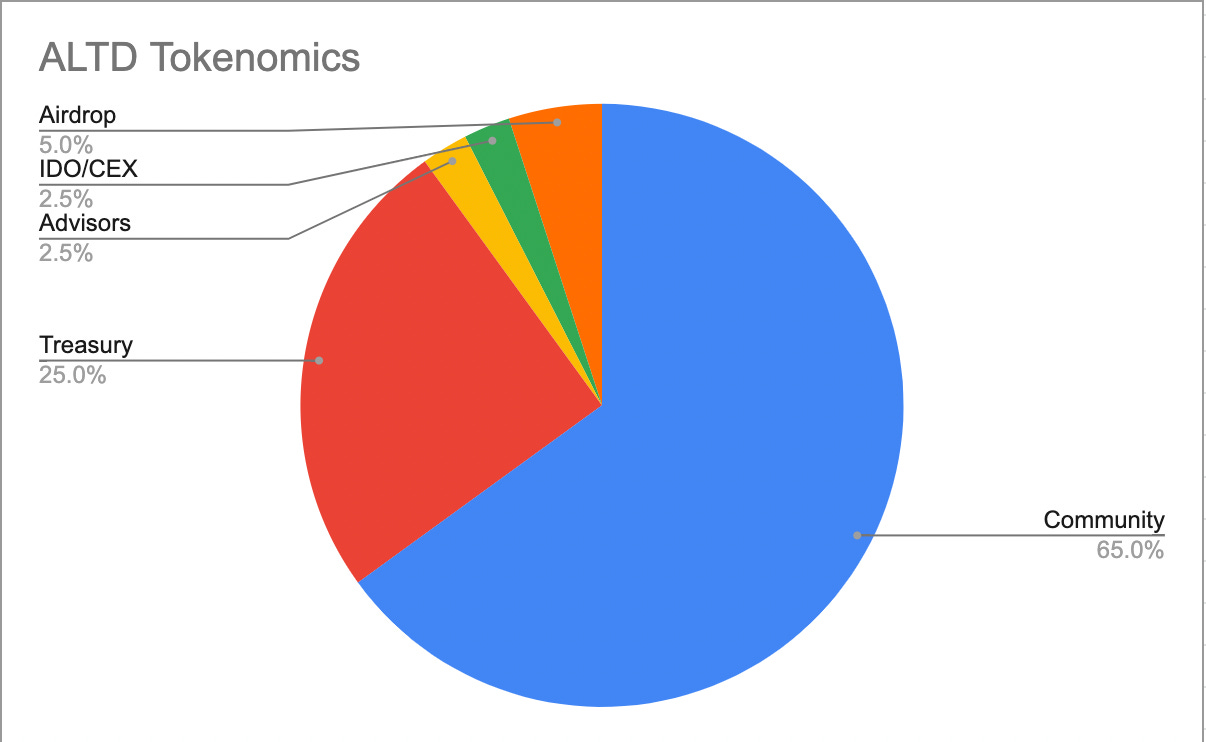

The ALTD token is the protocol-native token for Altitude. Your standard run-of-the-mill defi protocol token - it will be used for incentivizing rewards for LPs, as well as governance voting in the future. It also looks like an airdrop will happen as a way of incentivizing initial users and liquidity.

ALTD supply is fixed at 100,000,000

Read more on tokenomics: https://altitude-1.gitbook.io/altitude/ecosystem/tokenomics

The Emissions chart isn’t available yet, but block rate per liquidity pool will be determined by two things:

ALTD amount emitted per block, per chain

ALTD allocation per block, per pool on given chain

Keep an eye out here for updates in the future: https://altitude-1.gitbook.io/altitude/ecosystem/emissions

Fees

Altitude will use two different methods for collecting transaction fees:

Protocol Fee : 0.05% fee for withdrawing liquidity across chains

Rebalancing Fee: This one is a bit more technical, but it concerns the rebalancing of liquidity pools when user transfers from a high liquidity pool to low liquidity pool. In short, greater imbalance = higher fees.

Altitude references Stargate’s fee model in this case. Read more: https://altitude-1.gitbook.io/altitude/altitude/utility-or-fees

Collected fees will be redistributed to stakers.

Ecosystem

Altitude will be launching with a select set of supported networks and assets:

Supported Networks

Ethereum

Avalanche

BNB

Polygon

Fantom

Optimism

Metis Network

Supported Assets

$ETH

$MATIC

$BNB

$FTM

$ALTD (Native token)

For the full list of assets and smart contracts: https://altitude-1.gitbook.io/altitude/ecosystem/supported-assets

💭 Closing Thoughts: Why Altitude?

Now that we’ve gone over the HOW , let’s go over the WHY as we wrap things up

My conviction for Altitude can be summarized as follows:

Convenient bridging solution for your favorite bluechip crypto assets

native assets, cheap fees, security

Decentralized solution for bridging in a time where decentralization is as important as ever for Web3

large amounts of liquidity not required

independent chain paths means resiliency against network outages

Potential to onboard other chains/assets in the future.

I imagine Altitude will onboard other chains moving forward, like Solana and Cosmos, for example.

A permissionless model for forging bridge paths can help onboard lots of smaller projects as well, making Altitude a much more attractive alternative to bridges which require lots of initial liquidity for integration.

First mover advantage as one of the first dApps building on LayerZero

There is no denying that there is a lot of competition in the bridging sector for crypto. Protocols like Synapse are also building very promising models for seamless crosschain experiences.

However, competition is little to note in the LayerZero dApp ecosystem. The only relevant protocol is Stargate Finance, but as they are exclusive to crosschain stable swaps, there is no direct competition with what Altitude is bringing. And as we know in crypto, first mover advantage can be very beneficial for projects.

💎 Current Alpha

Altitude DeFi is still in its pre-launch phase. This means that no official UI, token, or liquidity pool is available yet. A roadmap is still in the works, so alpha is limited. However, if you would like to be more involved with Altitude here’s what you can do right now:

Currently, Altitude is still in its internal testnet phase. There could be potential opportunities for testnet access in the near future so keep an eye out on announcements.

In additional, the ALTD token will be launching in the near future, and an airdrop has been hinted on their website and docs 👀

Sources 📚

Altitude Docs https://altitude-1.gitbook.io/altitude/

Introducing Altitude https://medium.com/altitudedefi/altitude-bridging-made-easy-5d74c8b07d59

LayerZero whitepaper https://layerzero.network/pdf/LayerZero_Whitepaper_Release.pdf

LayerZero: A Deep Dive